News

Mobile commerce, rural consumers, and Ethiopia offer strong market opportunities for MNCs in Africa

New BCG report tracks the spending behaviors of African consumers and reveals where the strongest growth of future demand will likely come from

If projections hold, Africa will have over 1.1 billion consumers by 2020 – more than the populations of Europe and North America combined. And incomes are growing. In 2020, Africa will have twice as many affluent consumers as the UK, according to a new report by The Boston Consulting Group (BCG) and BCG’s Center for Customer Insight. The report, titled African Consumer Sentiment 2016: The Promise of New Markets, was released on 21 June 2016.

BCG polled 11,127 consumers across 11 African countries: Algeria, Angola, Côte d’Ivoire, the Democratic Republic of the Congo (DRC), Egypt, Ethiopia, Ghana, Kenya, Morocco, Nigeria, and South Africa. The consumers we surveyed represent a broad range of ages, incomes, education levels, and household types. Besides exploring the attitudes, budgeting, and spending behaviors of Africans, we tracked the effect of income levels on the purchase of specific products.

For multinationals hoping to capitalize on the continent’s growing consumer market, the report offers insights on where to invest marketing resources for the greatest impact. “Africa’s countries, markets, and consumers have varying tastes, preferences, and behaviors,” explains Stefano Niavas, a BCG partner and one of the report’s authors. “Understanding these differences is critical when trying to make inroads.”

Africa’s Consumers Are Very Optimistic

Our survey showed that 88% of African consumers are very optimistic about the future. This bodes well for the continent, because optimistic consumers are more inclined to buy, which helps drive an economy forward.

In the major consumer markets of Egypt, Kenya, and Nigeria, optimism is above 90%. The overall optimism of African consumers is reflected in their eagerness to buy new things and the high levels of happiness they derive from their purchases. Although Africans continue to highly value brands, especially global ones, today’s shoppers are more open to new brands – a development that bodes well for new products targeting the African market.

Mobile Phones Are Driving a Surge in Connectivity

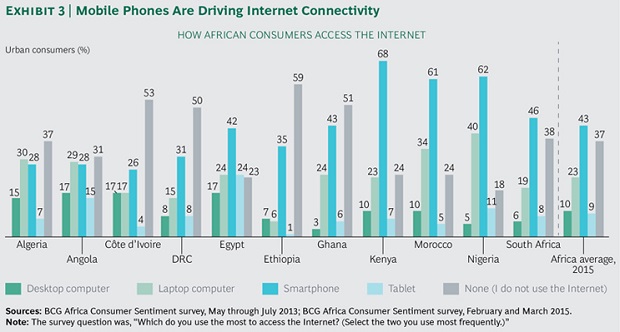

Internet access is growing rapidly – up 8% since 2013 among our survey respondents. At the time of our survey, 63% of consumers across the continent had online access, but connectivity reached 83% in some countries. Fully 75% of consumers with Internet access were online every day.

This growth of online access and the mobile Internet is creating new business opportunities in areas such as e-commerce, online advertising, and especially mobile financial services. But power outages and slower connection speeds overall will present obstacles. To succeed, companies will have to innovate and adapt to these conditions, as well as to the specific needs of African consumers.

The Promise of New Markets

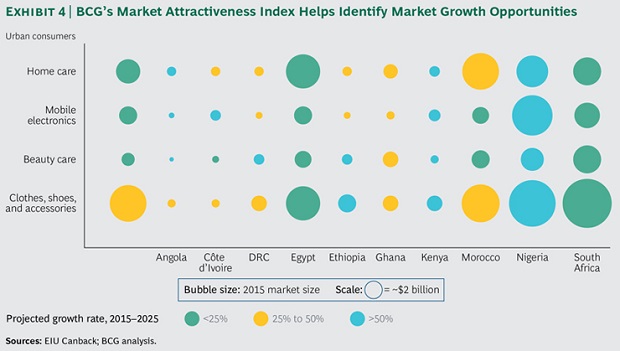

The report introduces BCG’s Market Attractiveness index, which aggregates our research to reveal the consumer markets and products showing the strongest growth – and growth potential. Our research pointed to the emergence of two potentially important markets.

The first is Ethiopia, whose economic strength and growth indicate a bright future. The second is Africa’s rural consumers, who are often overlooked by companies focusing on the continent’s urban populations. Since rural consumers are harder to reach than urban consumers, the cost to serve them is higher.

“To capitalize on the opportunity, companies will need to rethink how they market and distribute their products,” says Jacqueline Foster, a BCG consultant and one of the report’s authors. “Old-fashioned word of mouth and trust building are still the most effective marketing tools.” MNCs that succeed are creating innovative, tailored solutions.

The Connected African Consumer

The Internet is sweeping across Africa, as it is in the rest of the world, and connectivity is rising. Internet access is growing rapidly – up 8% since 2013 among our survey respondents. At the time of our 2015 survey, 63% of consumers across the continent had online access, but connectivity reached 83% in some countries. Fully 75% of consumers with Internet access were online every day.

New Business Opportunities

Mobile phones are driving this surge in connectivity. Of our survey respondents, 43% access the Internet with their smartphones, and mobile usage is growing compared with desktops, laptops, and tablets. This growth of online access and the mobile Internet is creating new business opportunities in areas such as e-commerce, online advertising, and especially mobile financial services. But connectivity in Africa may pose some challenges. Power outages leading to intermittent connection issues and slower connection speeds overall will likely present obstacles. To succeed, companies will have to innovate and adapt to those conditions as well as to the specific needs of African consumers.

In 2012, for instance, the Africa Internet Group launched Jumia – Africa’s version of Amazon.com – in Nigeria and designed it to fit local needs. As one of the founders explains, “We saw a big opportunity. The reason Africa is not more developed is due not to a lack of demand but to a lack of supply.” The e-tailer sells a wide range of products and offers a mobile purchasing application. To ensure success in Nigeria, Jumia offers a cash-on-delivery option to build trust, and keeps customer-service and delivery functions in-house for better quality control, rather than outsourcing them. Jumia also forms partnerships with telecom companies, tapping into their large subscriber bases and giving their customers access to the Jumia website. Today, Jumia is among the top five online-shopping websites in five African countries – Côte d’Ivoire, Egypt, Kenya, Morocco, and Nigeria.

Also capitalizing on Africa’s surge in connectivity is the Ethiopia Commodity Exchange (ECX), launched in 2008 to offer a secure, transparent, and trustworthy system for commodity trading. Before ECX, transactions in the country’s agricultural markets were high cost and high risk. To avoid being cheated or not getting paid, commodity buyers and sellers tended to trade only with people they knew. Only one-third of Ethiopia’s agricultural output reached the market. ECX provides a secure and reliable system for handling, grading, and storing commodities. The system matches buyers and sellers, offers risk-free payment, and provides a delivery system for settled transactions.

Information and communication technologies empower ECX buyers and sellers, including small farmers, to access markets more efficiently and profitably. For instance, the exchange offers text-messaging and call-in services in four local languages. Anyone in an area of the country where a mobile-phone network exists can access market prices, commodity-related news headlines, weather forecasts, and other relevant information. Currently, the messaging service has 800,000 subscribers and the call-in service receives 1.5 million calls per month.

Mobile Financial Services

Africa’s growing connectivity is also giving rise to a new market with enormous potential: mobile financial services. Today, more than 50% of all Africans over the age of 15 own a mobile phone. For most of these consumers, mobile banking will be their first experience with financial services. By 2019, an estimated 250 million “unbanked” Africans will have mobile phones and a monthly income of at least $500 – generating a projected $1.5 billion in revenues from mobile financial services. Given the high cost to serve and low margins of traditional bank accounts in Africa, financial services providers haven’t made the continent a priority. As a result, 75% of Africans don’t have a bank. Mobile phones make up for the absence of a banking infrastructure. Although Africans use their phones to prepay utilities, purchase small items, and make debit-card transactions, they use them mostly to transfer money. Many urban workers send a portion of their earnings to their families.

A major opportunity exists to expand the range and types of financial services offered through mobile phones, providing new ways for consumers to save, borrow, invest, and transact business. Microloans, mortgages, mobile music, e-commerce, safer forms of cash management for businesses – all are ways that the mobile platform could be used to generate new revenues. The key will be for banks and phone companies to work together to realize this market’s potential.

Banks have the most to gain from developing mobile financial services, because mobile phones offer a low-cost way to reach such a huge market. But banks have a limited understanding of lower-income consumers and what they want. To succeed in this market, banks must rethink their offerings to address the needs of the African consumer and create a cost-effective business model.

For their part, mobile network operators already have a low-cost communications network, some form of agent network, and a good understanding of the low-income African consumer. But the financial services they offer often don’t comply with banking regulations; the offerings of different network operators aren’t very compatible yet; and interoperability is limited.

Market Watch

In this report, we introduce BCG’s Market Attractiveness index, which aggregates our research to reveal the consumer markets and products showing the strongest growth – and growth potential. Our research pointed to the emergence of two potentially important markets. The first is Africa’s rural consumers, who are often overlooked by companies focusing on the continent’s urban populations. The second is Ethiopia, whose economic strength and growth indicate a bright future. Both of these markets are poised to generate increasing consumer demand.

BCG’s Market Attractiveness Index

When will the market for large household appliances in DRC be big enough to justify the entry of a new brand? At what income level will penetration of air conditioners in Nigeria be above 50%? Because the availability of detailed consumer data in many African countries is limited, BCG developed the Market Attractiveness index to provide answers to these types of questions. For consumer products companies hoping to enter new markets or increase their share in existing ones, the index can help identify the most lucrative growth opportunities. For instance, while the markets for clothes, shoes, and accessories in Ghana and Kenya are of a similar size today, Kenya’s market is projected to grow 18% more quickly than Ghana’s over the next ten years. Similarly, although South Africa is currently the largest market for beauty care among the 11 African countries included in this report, Ethiopia will be the fastest-growing market for these products over the next ten years. The index includes estimates of market size – for today and projected forward ten years to 2025 – for 19 consumer categories across the 11 countries.

In our survey, we asked respondents to indicate which of 17 household-income brackets their families fit into, ranging from less than $50 per month to more than $7,000 per month. We also asked them to estimate how much money their household spends per month on each of the 19 consumer categories, ranging from recurring expenses such as food and utilities to big-ticket items such as education and health care. We then combined this data, showing how much more – or less, in some cases – households spend on different categories as incomes increase, with 2015 estimated and 2025 projected household-income data by country across defined income brackets. The output is an index that estimates the market size of different categories both today and in the future.

Rural Consumers

Given headlines such as “Urban Consumers Will Power Africa’s Rise” and “African Cities in Particular Are Booming,” it’s no wonder that MNCs are focusing their efforts on Africa’s urban markets. With their expanding consumer bases, rising incomes, and relative population densities, cities are indeed the place to start for most businesses. But the continent’s growing rural markets can offer significant opportunities for companies that already have an extensive urban presence and the capital and know-how required to successfully penetrate new markets. “The next million customers will come from there,” says Zunaid Dinath, chief officer of sales and distribution for Vodacom, a regional telecommunications company based in South Africa.

In terms of purchasing behavior, our survey showed that Africa’s rural and urban consumers are quite similar. Rural consumers value quality just as much as their urban counterparts do, and are willing to spend more for better cars, electronics, beauty and baby products, spirits, and certain foods. Demand for household appliances, mobile phones, and clothing is particularly strong. However, spending power differs. The average income of rural consumers across the 11 countries we surveyed is 49% less than that of urban consumers.

We currently see rural markets as a niche opportunity for MNCs that have largely captured the urban opportunity – in sectors such as mobile phones, soft drinks, and banking. We recommend that players in other sectors continue to focus on urban markets and reevaluate the rural opportunity as it develops.

MNCs that are ready to enter rural markets should understand that rural consumers are harder to reach than urban consumers, so the cost to serve them is higher. To capitalize on the opportunity, companies will need to rethink how they market and distribute their products. Rural consumers are less exposed to the media and marketing methods, and tend to be less trusting of the unfamiliar. Old-fashioned word of mouth and trust building are still the most effective marketing tools. That’s where “zonal champions” come in.

A concept developed by a marketing agency, The Creative Counsel, as a way to reach rural consumers, zonal champions are members of local communities who are hired to represent a brand and to promote products during their daily interactions. The objective is to persuade friends, family members, and neighbors to try something new.

Distribution and logistics challenges are typically cited as principal barriers to reaching rural consumers. Once again, innovative and tailored solutions are the answer. Some companies make it easy for even the smallest shops to market and sell their products by providing signage for stores, creating shipping cases that become compact displays that fit into a smaller retail footprint, offering small package sizes at the right price points, and using wholesalers and other third parties to expand distribution.

Coca-Cola established micro distribution centers (MDCs) to help its third-party distributors in rural areas that are difficult to reach and serve. Although the company’s preferred model is to have bottlers handle direct distribution to all retail outlets, the MDCs are a way for Coca-Cola to adapt to the rural environment. Each MDC gets an exclusive territory franchise, as well as additional support services such as microcredit and loans for trucks and other assets, in addition to training in advertising, merchandising, accounting, and recruiting.

Ethiopia, the Next Frontier

A number of macro trends indicate a bright future for this African country. According to the International Monetary Fund, Ethiopia’s GDP grew by 10.2% in 2015 – making it the fastest-growing country in the world. It’s becoming easier to do business there, too. The number of days required to start a business dropped from 46 in 2004 to 15 today, and the cost of starting a business decreased from about $700 to $400. Another good sign: Ethiopia’s government is upping its level of investment, having directed about 15% of GDP toward large infrastructure projects and having doubled health care spending since the late 1990s. Global consumer-products companies are starting to take notice – and action.

Although doing business is only slightly more challenging in Ethiopia than it is in other African countries, starting a business is harder. The government requires higher fees and more capital for start-ups relative to other countries and is strict in its oversight of businesses. Since Ethiopia is a landlocked country heavily reliant on access to the Djibouti seaport, trading across borders is also more problematic. Export times are longer and related costs are higher.

Because of these obstacles, MNCs need patience and persistence to make inroads, but many global leaders in consumer products believe it’s worth the effort. Coca-Cola has designated Ethiopia as its fourth-most-important market in Africa. The company has been in Ethiopia since 1959, now owns two factories, and is investing in three new bottling plants worth a total of $500 million. Greig Jansen, then CEO of the East Africa Bottling Share Company, explained the company’s ambitious plans in 2013: “Our strategy is to have a cold Coca-Cola within arm’s reach for all our consumers in Ethiopia by 2020.”

Beer maker Heineken is also investing heavily to capitalize on Ethiopia’s emerging consumer demand. Founded in 2011, Heineken Ethiopia has seen the country’s beer market double in five years. The company invested $220 million in two bottling plants and launched an Ethiopian brand, Walia. Heineken’s current strategy is to build on its momentum. The company is investing $120 million in a state-of-the-art brewery that will be the largest in Ethiopia and will double the company’s potential output. The next step is to launch the Heineken brand and capture the superpremium market. Jean-François van Boxmeer, Heineken International’s CEO, explains, “We are investing ahead of the curve, and with a long-term ambition to create sustainable businesses. The beer category in Ethiopia has huge potential.”

Consumer sentiment among Ethiopians is also positive. Perhaps because the country’s GDP growth is so strong, Ethiopians feel more financially secure than many other Africans. Their savings rate is the second highest in Africa and it is increasing.

» Download a copy of the report at Bcgperspectives.com.