News

Mozambique Economic Update: Growth slows amid challenging global conditions and rising fiscal risks

After several consecutive years of accelerating growth, Mozambique’s economic performance eased to its slowest pace since 2009, whilst the economy remains increasingly exposed to heightened levels of fiscal risk, according to the Mozambique Economic Update released today.

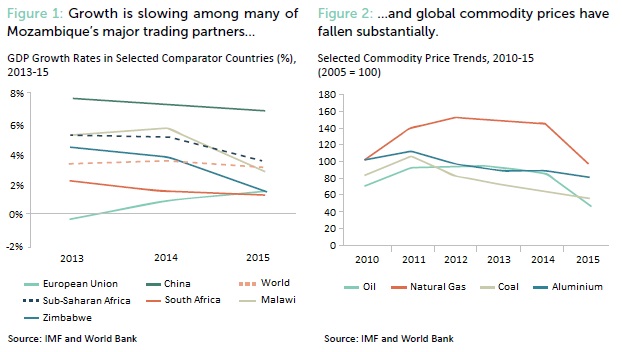

Mozambique’s economy continues to face challenges of weaker commodity prices, lower demand amongst trading partners and rising U.S. interest rates, according to the inaugural edition of the Mozambique Economic Update (MEU). The already difficult headwinds are further aggravated by regional drought, falling investment levels, political instability and rising debt levels. Amid these conditions, the report predicts growth will continue to slow this year.

“Given the current environment, it’s important for Mozambique to press ahead with reforms aimed at securing macroeconomic stability whilst also maintain the longer term focus on a resilient and diversified economy,” said Mark R. Lundell, World Bank country director for Mozambique, Madagascar, Mauritius, Seychelles and Comoros. The report covers the period to March 2016.

Recent Economic Developments and Outlook

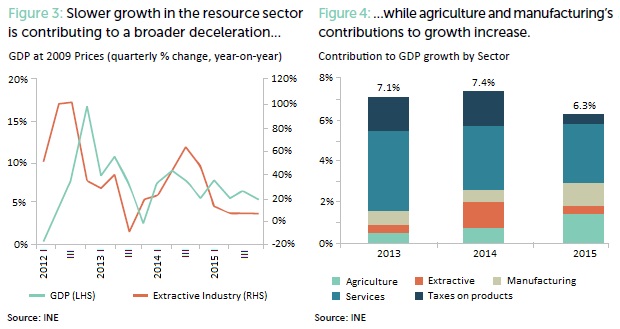

The MEU reviews recent economic developments and assesses near-term economic prospects, forecasting that growth will slow further to 5.8% in 2016, before rising above 7% in 2017. Much like other resource-rich countries, the Mozambican economy continues to face the challenges of low commodity prices and weak demand amongst trading partners, as well as regional drought. These difficult conditions are further aggravated by falling investment levels and rising public debt. In 2015, foreign direct investment fell by 24 percent, exports declined by 14 percent and growth decelerated to 6.3 percent, its slowest level since 2009.

The projected slowdown in 2016 reflects the continued decline in commodity prices for key Mozambican exports, effects of the ongoing drought on agricultural production, and further fiscal tightening, according to the report. This outlook is subject to additional downward risk if gas megaproject investments are deferred to 2017 the report says, and if rising debt levels result in sharper policy adjustment. Given the weak external position, the report notes further currency depreciation is likely and will add to inflationary pressures in 2016.

The adverse external environment is expected to persist through 2016. The report projects that a continued decline in prices for key exports, the ongoing drought and further fiscal tightening will further decelerate GDP growth to 5.8 percent in 2016, before recovering to over 7 percent in 2017. This outlook is subject to further downward risk if investment levels remain subdued and if rising debt levels lead to sharper fiscal and monetary policy adjustments.

Although short-term economic pressures are pronounced, the MEU notes that medium-term prospects for economy remain sound. Large investment flows from the gas sector are expected between 2017 and 2020. These flows will support the widening of the current account deficit and boost growth. Gas exports are expected to ramp up by 2022 and the current account deficit to shrink thereafter.

“Short-term pressures in 2016 point to the importance of rebalancing the external position, rebuilding international reserves and securing final investment decisions for the development of the Rovuma basin gas fields,” noted Shireen Mahdi, World Bank Senior Country Economist for Mozambique.

Special Focus on Fiscal Risk

The report also includes a special focus section on public investment and fiscal risk arising from public debt, guarantees, state owned enterprises and public private partnerships. Mozambique has been substantially scaling-up public investment over the last few years. Financing has taken various forms. However, liabilities have accumulated at a rapid pace while the due diligence mechanisms to govern them more efficiently lagged. The report highlights the need to improve monitoring, disclosure and management of debt and fiscal risks. These efforts should be complemented by measures to improve the government’s capacity to appraise and manage public investments.

“It will be increasingly important that the authorities ensure thorough assessment of the country’s fiscal risks and increase transparency through greater disclosure,” highlighted Lundell.