News

IMF Executive Board 2015 Article IV Consultation with Botswana

On March 16, 2016, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Botswana.

After a rapid recovery from the 2009 downturn, GDP growth is estimated to have turned slightly negative in 2015 owing to a decline in the global demand for diamonds and copper. Non-mining activities, while recording positive growth over the year, remained subdued owing to spillovers from lower mining activity, a regional drought, and electricity and water shortages. Inflation has been declining over the past few years and is now close to the lower bound of the Bank of Botswana’s objective range of 3-6 percent, reflecting a successful monetary policy, lower fuel prices, and an appreciation of the Pula against the South African Rand.

After three years of surpluses, the government balance has turned into a deficit, reflecting lower mining revenues, a decline in revenues from the South African Customs Union (SACU), and higher fiscal spending, part of which is related to the Government Stimulus Program. The deficit has been financed by drawing on previously accumulated savings and incurring a small amount of domestic debt. The external current account surplus has also been declining, but is estimated to be in positive territory. As Botswana entered the current downturn with large fiscal and foreign reserve buffers, the country is well positioned to deal with the decline in export demand.

A gradual economic recovery is projected in the next three years, based on an expected gradual increase in diamond prices and fiscal stimulus, while inflation is expected to remain within the BoB’s objective range. The 2016/17 budget submitted to Parliament in February envisages a fiscal deficit of about 4 percent of GDP as a result of lower mining and SACU revenues and higher capital expenditures. In the medium-term, the macroeconomic framework envisages fiscal consolidation based on a gradual recovery of the mining sector and expenditure rationalization (the authorities plan to contain the growth of wages and salaries and reduce transfers to state-owned enterprises).

Lastly, the external current account surplus is projected to narrow further this year, but gradually reverse to trend thereafter along an expected recovery in export prices. Botswana’s diamond endowment and its track record of good macroeconomic policy management and political stability contributed to high average economic growth and strong fiscal and balance of payments positions in recent years.

Beyond these achievements, the authorities see a need to reduce unemployment, eliminate water and electricity shortages, and improve the efficiency of government operations. In addition, given the limits of the diamond and public sector-based growth model (diamond reserves could be exhausted by 2050 and inefficiencies in the public sector), a wave of reforms is called for to foster the development of the private sector, diversify the economy, and improve the skills of the labor force.

Staff Report

Real GDP growth is estimated to have turned negative in 2015 owing to weaknesses in the global demand for diamonds and a deceleration of activity in the non-mining sector, driven mainly by spillovers from lower mining activity. Inflation has been low and is now near the lower bound of the Bank of Botswana objective range of 3-6 percent.

The economy is expected to recover gradually over the next three years, driven by a gradual pick up in global diamond prices and fiscal stimulus. The main risks to the outlook are a slowdown in economic activity in major advanced and emerging markets and delays on restoring reliability and self-sufficiency in water and electricity and in implementing other structural reforms.

The 2016/17 budget presented to Parliament in February envisages high levels of public investment and a higher fiscal deficit. The stimulus is justified in the face of a negative output gap, strong fiscal buffers, and the need to close the infrastructure gap. However, its scale may be ambitious given past difficulties in implementing infrastructure projects. The Bank of Botswana’s accommodative monetary policy stance is appropriate, although the space for further monetary easing will be constrained by the fiscal expansion. The financial sector is stable but requires continued monitoring.

In the near-term, the priorities are to increase the efficiency of public investment, reform the water and energy sectors, and improve workers’ skills and the business environment. In the medium-term, the growth strategy needs to be focused on a few areas and backed by bold reforms to mobilize domestic revenues, rationalize government spending and state-owned enterprises, implement a well-prioritized public investment program and consider adopting a sound fiscal rule, and improve education and labor market policies.

Recent Developments

The economy has entered a period of weakness connected to a decline in the global demand for diamonds which have also affected the country’s fiscal and external positions, while successful monetary and financial policies have kept inflation in check and the financial sector stable.

The economy has been slowing down, while inflation has been within the Bank of Botswana’s objective range of 3-6 percent. Following a healthy recovery after the 2009 downturn, economic growth slowed down in 2014 and is estimated to have come to a halt in 2015. Both external and domestic factors contributed to the slowdown. Mining GDP was affected by a decline in the global demand for diamonds and copper, while non-mining GDP decelerated owing to spillovers from lower mining activity, a regional drought, electricity and water shortages, and less favorable domestic credit conditions. The decline in non-mining GDP growth was cushioned by an expansionary fiscal policy. Inflation has also been in decline (the 12 month-rate of inflation was 2.7 percent in January 2016), reflecting a prudent monetary policy, lower fuel import prices, and a recent appreciation of the Pula against the South African Rand.

After three years of surpluses, the government balance has turned into deficit. The fiscal deficit for FY 2015/16 (the fiscal year runs from April 1) is estimated to be in the order of 3 percent of GDP on account of lower mineral revenues, reduced receipts from the Southern African Customs Union (SACU), higher wages and transfers to state-owned enterprises, and higher capital expenditure. The latter reflects an “Economic Stimulus Program” that began to be implemented in the second half of 2015 to counteract the economic slowdown and includes higher capital expenditures targeting the tourism, transport, and agriculture sectors. As Botswana entered the downturn with sizable fiscal savings, the deficit is being primarily financed by government deposits.

The current account surplus has declined, but foreign reserves remain high. The current account surplus is estimated to have fallen from a peak of 16 percent of GDP in 2014 to about 9 percent in 2015 on account of (i) lower prices and volumes of diamonds and copper exports; and (ii) lower SACU revenues. Despite a small decline in 2015, the stock of foreign exchange reserves remain comfortably high at US$7.5 billion (65 percent of GDP), well above the upper bound of the optimal range estimated by the Adequacy of Reserves Assessment metric (Appendix I).

Minor adjustments were made to the exchange rate framework. To better reflect trading partners’ trade weights and inflation differentials (particularly an increase in South Africa’s projected inflation), the Bank of Botswana (BoB) increased slightly the target rate of crawl of the Pula from a downward crawl of 0.16 percent in 2014 to zero in 2015 and to 0.38 in 2016, and reduced the basket weight for South Africa from 55 to 50 percent in 2015.8 The real effective exchange rate remained virtually unchanged in 2015, and the staff assessment of the real value of the Pula suggests that it is consistent with economic fundamentals (Appendix II).

Monetary policy has been eased but transmission through the credit channel has been weak. In the context of declining inflation, the BoB reduced its policy rate from 7.5 in 2014 to 6 percent in 2015. These cuts have been consistent with cyclical developments as confirmed by a standard Taylor rule. Even though the prime lending rate fell in response to policy easing, credit growth declined as commercial banks adopted a cautious approach to lending in the context of slow growth in customer deposits and increasing competition to raise funds. To further ease liquidity conditions, the Primary Reserve Requirement on Pula denominated deposits was reduced from 10 percent to 5 percent in 2015.

The financial system is stable, but some vulnerabilities remain. There are 11 banks in the system alongside several non-bank financial institutions providing a variety of modern services. Banks are well capitalized, with an average capital adequacy ratio of 21 percent and a low share of non-performing loans (4.5 percent of total gross loans). Nevertheless, asset quality deteriorated during the past year, profitability declined slightly, and funding conditions became more challenging, especially for smaller institutions. While the system remains sound, a major economic contraction could raise stability risks given lenders’ relatively large exposure to households (59 percent of total bank loans), which is mainly in the form of unsecured lending (about 65 percent of total credit to households).

Outlook and Risks

Armed with ample savings and foreign reserves, the authorities are well-positioned to weather the current slowdown. The economy is expected to recover gradually, driven by a pick up in the global demand for diamonds and fiscal stimulus, while custom receipts are expected to remain subdued. The main risks to the outlook are sluggish external demand for minerals and slow or insufficient reforms.

The baseline scenario assumes a gradual recovery in the next three years and modest growth in the longer term. The projection is based on the assumption of a measured recovery in global diamond and copper prices (Box 1). It also reflects the impact of higher government spending and investments in the energy and water infrastructure, together with gradual reforms to improve the business environment, which could bring real GDP growth towards 5 percent by 2019. Subsequently, the baseline projects annual average real GDP growth of around 4 percent based on the withdrawal of the fiscal stimulus and continued prudent macroeconomic policies and economic reforms. Inflation is projected to remain within the BoB’s objective range.

The fiscal and external positions are expected to deteriorate further in 2016 and improve thereafter. The 2016/17 budget entails a fiscal deficit of about 4 percent of GDP, the result of lower mining and SACU revenues and the continued implementation of the government’s stimulus program. Fiscal consolidation is expected over the medium-term, based on a gradual recovery of the mining sector and expenditure rationalization. On the latter, the authorities envisage containing the growth of wages and salaries and lowering transfers to state-owned enterprises, especially electricity and water. Regarding the external position, the current account surplus is projected to narrow further from 9 percent of GDP in 2015 to about 2 percent in 2016 and reverse trend thereafter, alongside a projected recovery in diamond prices and volumes (supported by a gradual pickup in global demand).

An alternative scenario entailing a stronger reform effort and prioritized public investment has a better chance to address Botswana’s challenges. Staff prepared an alternative scenario that suggests that, with accelerated reforms, a gradual and well-prioritized public investment program, and improved efficiency in the public sector, the country will be in a better position to achieve economic diversification, higher growth, and a transition to high-income status.

There are important risks to the outlook. In the near term, the main downside risks are: (i) sluggish growth in key advanced and emerging economies, that could lead to continued weakness in the demand for diamonds (and copper); (ii) unresolved economic problems in South Africa and continued depreciation of the Rand, which could lower SACU receipts and have a negative impact on regional investors’ sentiment; and (iii) delays in plans to restore reliability and self-sufficiency in the water and electricity sectors, which would have adverse impact on costs, the fiscal balance, and the business environment; as well as delays on other structural reforms (e.g. deregulation and removal of red tape).

On the upside, a faster than expected recovery in the global demand for minerals could enable a faster recovery. In the longer term, the main risks relate to insufficient or ineffective actions to improve the efficiency of public investment and foster fiscal consolidation, economic diversification, and inclusive private sector-led growth.

Box 1. Botswana: Developments in the Diamond Industry

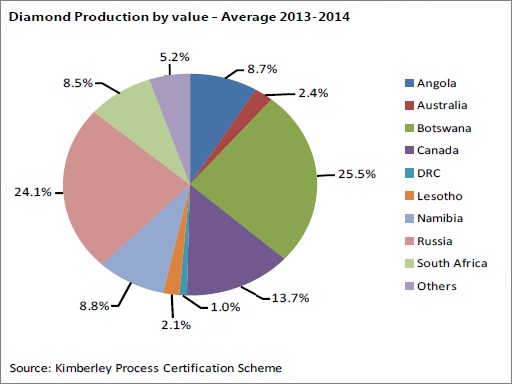

Diamond production is concentrated in two major country groups: a northern one, which includes Russia and Canada, and a Southern one that includes mainly Southern African states. There is another, less significant, group that produces diamonds of lower value and includes the Democratic Republic of Congo. The top three producing countries are Botswana, Russia, and Canada, accounting respectively for 25.5, 24.1, and 13.7 percent of world output, respectively. The rough diamond market is dominated by two companies: De Beers and ALROSA, each accounting for 34 and 25 percent of the world market. On the demand side, the U.S. represents about 40 percent of the global market for polished diamonds, followed by China/Honk Kong/Macau (15 percent), India (8 percent), the Gulf Region (8 percent), and Japan (6 percent).

The global demand for polished diamonds started to fall in the second half of 2014 prompted by a slowdown in China’s economy and signaling a reversal from a period of high growth (which had led to overly optimistic market expectations). This, together with a slowdown in other markets, led to an accumulation of inventories of polished diamonds and lower demand for rough diamonds. Between mid-2014 and September 2015, prices for polished and rough diamonds decreased by 12 and 23 percent respectively. Consequently, major producers started cutting production beginning in the second half of 2015. In Botswana, De Beers reduced production by about 20 percent in 2015 and announced further cuts for 2016. Debswana – the 50/50 joint venture between De Beers and the government of Botswana – put its Damtshaa mine on care and maintenance status and plans to scale down production at the Orapa 1 mine for the period 2016-2018.

Notwithstanding these negative developments, market observers coincide that with a careful management of supply, diamond prices may rebound as excess inventories clear, although uncertainties remain as to whether the recent decline in demand is transitory or structural (as diamonds are not a exchange traded commodity, information on prices and volumes is limited, which constrains the scope for analytical work on developments and prospects). For instance, Bain and Company (2015), expects demand to return to a long-term growth trajectory of 3-4 percent per year, relying on strong fundamentals in the US and continued growth of the middle classes in India and China. At the same time, the U.S. market is largely saturated, and while demographic changes in the faster growing countries would in principle favor increased demand for diamonds, consumer preferences in younger generations across the globe may be shifting. On the supply side, output is expected to decline by 1-2 percent per year through 2030, based on an analysis of existing and prospective volumes inferred from publicly announced plans by producers. Other factors that could affect market developments are, on the one hand, the recycling of diamonds and the emergence of synthetic stones and, on the other hand, the fact that new diamond deposits could be further underground and much more costly to extract.

Lastly, the industry faces other challenges in its value chain. Cutting and polishing firms may not be robust enough to cushion against short-term fluctuations in the retail market, given their constrained bargaining power over producers and retailers and limited access to financing. In fact, lower margins are driving weaker firms out of business, most of them in Africa (in 2015, the combined market share of cutting and polishing firms in China and India rose to 85 percent while the share of African companies declined, reflecting insufficient competitiveness of the latter).

Policy Discussions

The discussions focused on the near term policy mix to counter the economic downturn, contain fiscal risks, and preserve financial stability as well as on selected medium-term issues, namely measures to improve the efficiency of public investment, strengthen the frameworks for managing mineral revenues and the financial sector, and foster job creation and private sector-led growth.

-

Policy Mix, Fiscal Risks, and Financial Stability

As the fiscal stimulus is rolled out, additional monetary easing may not be required, but the authorities need to be cautious with public investment projects and consider reforms to mobilize revenue in order to limit fiscal risks. Financial sector risks call for continued close monitoring of the sector.

-

Enhancing the Framework for Economic and Financial Stability

Building on a good track record of fiscal soundness and macroeconomic stability, there is scope to strengthen the framework for managing mineral revenues and safeguard financial stability.

-

Diversification and Inclusive Growth

Progress with economic diversification has so far been limited and high levels of unemployment persist, with most employment creation coming from an oversized public sector. Looking ahead, well-prioritized investments in education, energy, water, and other infrastructure will be critical, supported by reforms to improve the business environment and the efficiency of the public sector.