News

Mapping global and regional value chains in SACU: Sector-level overviews

Global Value Chains and Regional Integration in SACU

Global value chains and the link to regional integration

In considering the prospects for expanding non-commodities exports, the SACU region faces a global environment that has changed markedly over the past two decades. First, trade is increasingly shifting away from high income countries and toward developing countries. Second, and perhaps most importantly, is the increasing importance of or “global production networks” or “global value chains” (GVCs). With wages rising rapidly in China and other places where GVC-oriented trade is concentrated, parts of these value chains are migrating to new global locations. Some estimates indicate that over the next generation 85 million manufacturing jobs will migrate from coastal China, and Sub-Saharan Africa is expected to be a major beneficiary. The SACU region – with its abundance of natural capital and surplus labor, along with a relatively high quality infrastructure and institutional environment – should be in a good position to attract investment and create a “Factory Southern Africa”.

Beyond assembly manufacturing that is typical of GVCs (e.g. apparel, electronics, automotive), the region should also be well-placed to compete as a location for valueaddition to agricultural and mineral commodities (“beneficiation”). Both types of investment would not only drive exports and have the potential to create significant employment, but also support upgrading by accessing global technologies and knowledge. And with growing markets across Africa, a “Factory Southern Africa” might increasingly be sustainable in the regional context.

Competing in GVCs will require scale economies that are limited in the region, and non-existent outside of South Africa. For this reason, South Africa will play a critical role as a demand engine and gateway, but it will rely on the rest of the region in order to benefit from differing sources of comparative advantage across the countries. Indeed, regional integration in the context of global value chains is likely to be the key to successful export-orientated growth in SACU. International evidence suggests that regional integration can be a driving force for growth and income convergence. In Europe, for example, the single market has facilitated private capital flows from richer to poorer countries and from low to high growth economies, resulting in faster convergence in incomes and living standards than anywhere in the world. In East Asia similarly, greater integration has led to the development of advanced regional production networks that have underpinned its spectacular growth from a poor, underdeveloped agricultural backwater to becoming the global factory today. At the heart of this integration is the linkage between trade in goods; investment in regional supply chains, technology and business relationships; and the use of efficient infrastructure services (telecom, internet, transport) to coordinate dispersed production.

The current state of global and intra-regional trade in SACU

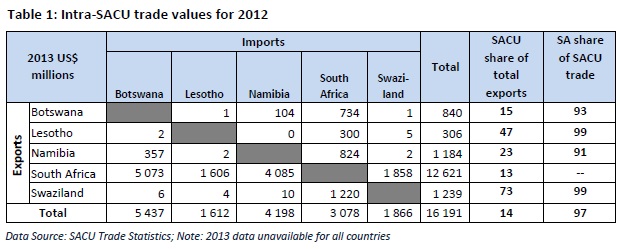

From an export perspective the region can be characterized as having two types of countries. First, Botswana, Namibia, and (to a lesser extent) South Africa rely heavily on the mining sector and the exports of raw materials, with most exports going outside the region. Second, Swaziland and Lesotho have narrow but well-developed industries that drive most export earnings: in the case of Swaziland it is sugar and (related) concentrated beverage syrups; in Lesotho it is apparels and textile. While these countries also export globally, they have a much greater reliance on regional markets. Taking exports and imports together, SACU’s value of trade within its borders equals approximately 14% of its total trade with the world, which is higher than the estimated percentage the African continent trades with itself (10% of total world trade). What is most pronounced about this regional trading landscape is the dominance of South Africa (Table 1). South Africa accounts for 97 percent of all trade in the region (which slightly ahead South Africa’s share of regional GDP) and runs a very large trade surplus with the region. The remainder of countries run extremely large intra-regional trade deficits, principally driven by bilateral imbalances with South Africa. Outside of South Africa, only Namibia and Botswana have developed bi-lateral trade of any significance, while Swaziland and Lesotho hardly feature in any regional trade outside of South Africa.

The second main point about regional trade is its product and sector nature. Here, we see that trade within SACU differs substantially in terms of sectors and products versus what member countries trade outside the region. This is unsurprising, particularly for those countries that are primarily mining and other commodity exporters. Intra-SACU is dominated by food and manufactures, with relatively small volumes of commodity trade. But while food trade is significant in agricultural raw materials appears to be relatively limited, suggesting that regional agrofood value chains may not be well developed. And while most countries export mainly manufactured goods in the region, Namibia, notably, is concentrated in food exports with very limited manufacturing exports.

Looking in more detail at the products that are traded within the region, although trade is fairly diverse, the nature of products exports from South Africa to the region differs significant from those exported from the rest of SACU to South Africa. Specifically, outside of mineral fuels (which is the largest export sector), South Africa’s exports are dominated by vehicles and machinery and equipment, along with iron and steel. The trade appears to be chiefly ‘endproduct’ sales. For example, a review of the trade data on for motor vehicles (HS 87) shows around 82 percent of trade is concentrated in end-products, with 18 percent (worth around US$ 220 million) in parts and components. The exports from the rest of SACU into South Africa is more eclectic, with soaps and detergents being the single largest category, and cocoa products, iron and steel, and plastics featuring prominently. There is some evidence of higher parts and components exports coming from SACU countries into South Africa, although this still appear to be relatively small.

The integration gap and regional industrial policy

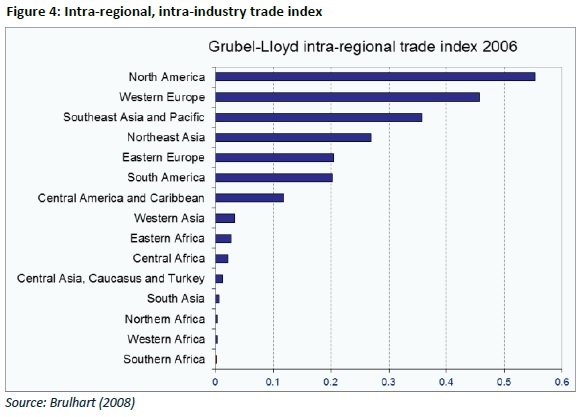

The brief overview of trade statistics outlined above gives an initial indication that integrated regional supply chains are not yet prominent in SACU. While it may be the case that some individual supply chains have developed across the regions, certainly there is no broader ‘Factory Southern Africa’. This is also true if one extends the geographical scope to encompass the wider Southern Africa (SADC) region. Indeed, Figure 4, which calculates intra-industry trade (parts and components within the same industry) within regions, shows that production chains in Southern Africa are among the least integrated in the world. This stands in stark contrast to the tightly integrated regional production networks that exist in East Asia, as well as in North America and Western Europe. This is partly explained by the emphasis on commodity exports in the region and the relatively limited complementarity of existing production structures. But even in this context, the level of regional integration of value chains is remarkably low in Southern Africa. Certainly, participating in GVCs would necessitate greater movement of parts, components, and services activities across regional borders. This underscores the importance of deeper and more effective integration arrangements that would enable value chains to operate seamlessly across the region, minimizing transaction costs and lead times. Moving even some way toward the level of integration in other parts of the world will, therefore, require significant improvements in the regional environment for cross-border trade and investment.

In this context, SACU has started work on developing a common industrial policy, which is fundamental to achieving the objectives of deeper regional integration as contained in the 2002 SACU Agreement. A SACU Task Team has been formed to oversee the development of the industrial policy framework. Central to the regional industrial policy is the development of integrated regional value chains (RVCs) that exploit of the comparative advantage of member states, and therefore not only support regional integration but more importantly productivity and competitiveness. Such RVCs may operate fully within SACU, but in most cases they are likely to be linked – upstream, downstream or both – into wider regional (African) and global value chains. It is therefore imperative that the RVCs being considered within the context of the SACU Industrial Policy function well to allow effortless integration into global value chains. And this is a two-way relationship. A recent paper by the Asian Development Bank suggests that regional economic integration within a GVC environment – through logistics, information network and connectivity improvement – can deliver substantial benefits from scale, network, coordination and agglomeration economies, with particularly strong benefits for small economies.

Objectives and Approach

While across the region there is significant interest integration of RVCs and, more broadly, integrating into GVCs, there remains limited evidence of the extent of current integration. The textile and apparel sector has been documented most. To date, however, limited information is available on value chain development across most sectors in the region. This report is intended to help address that gap by providing a broad overview of global and regional value chain participation in SACU member countries across a number of sectors. Specifically, the report provides case examples of GVC participation and the extent of SACU regional value chain development in 6 broad sectors: automotive; apparel; agro-processing; meat, livestock, and dairy; minerals; and tourism. These six broad sectors cover most of those that are being prioritized within the regional industrial policy. They also provide a balance among industries that are manufacturing-oriented and ‘traditional’ GVC industries (textiles/clothing and automotive), those linked to the agricultural sector (agroprocessing and meat, livestock, and dairy), mining, and services (tourism).

This report compiles sectoral value chain case studies that were carried out as part of parallel work, including the SACU Regional Trade and Transport Facilitation Assessment and previous report on Mapping Regional Value Chains in SACU. As the two studies were carried out for different purposes and with a different approach, the structure and focus of the outcomes are not fully consistent across sectors presented in this report. However, in all sectors, the case studies provide an overview of the structure of the value chain and interlinkages across firms in SACU, along with their positioning in wider GVCs. They also provide some discussion of the main constraints impact GVC participation and competitiveness, as well as the constraints to developing more integrated RVCs.