News

Public roads with private money: A way ahead

When you drive over potholes on downtown streets, are forced to make large detours to cross rivers lacking bridges, and finally arrive to find no cell coverage, connections between the global infrastructure investment gap and your pension fund might not be the immediate thing that comes to mind.

But it should, because:

-

Huge pools of available assets: pension funds, insurance companies, mutual funds and sovereign wealth funds sit on $100 trillion in assets. To compare: U.S. nominal GDP in the third quarter of last year was $18 trillion.

-

Huge infrastructure investment gap: between $1 to 1.5 trillion per year worldwide.

By putting to work a small portion of the privately owned $100 trillion for global infrastructure development, the positive impact on the global economy could be bigger than any other source of large-scale private investments.

In a new paper, From Global Savings Glut to Financing Infrastructure: The Advent of Investment Platforms, several economists at the IMF, in academia, and business explored the problem of how to lure badly needed private investment into meaningful infrastructure projects on a global scale.

To enhance the cooperation between public and private partners, there is a new class of facilitators like the European Investment Bank or the Asia Infrastructure Investment Bank. But how can they avoid engaging private investment in inefficient infrastructure projects, bridges to nowhere, or avoid granting too generous concession terms, like high highway tolls?

The paper makes a number of suggestions, including the creation of infrastructure securities and a global infrastructure investment platform.

Introduction

The policy debate on global infrastructure financing has reached unprecedented levels. Media coverage is dominated by discussions about the fallout from the creation of the Asian Infrastructure Investment Bank (AIIB), initiated and led by China. Controversy and debates have become heightened on account of many European and Asian countries having formally announced their commitment to join the infrastructure bank, while the US has opted to stay out and actively lobbied to discourage several countries from becoming members of the AIIB. Other so-called “infrastructure investment platforms” have been set up by development banks, though they have received considerably less international attention. The principal objective of these specialized investment platforms is to tap into the pool of both public and private long-term savings in order to channel large pools of capital into infrastructure investments. The goal of the present paper is to provide a detailed overview of these new initiatives, and to critically analyze the building blocks of the emerging global landscape for public-private co-investments in infrastructure.

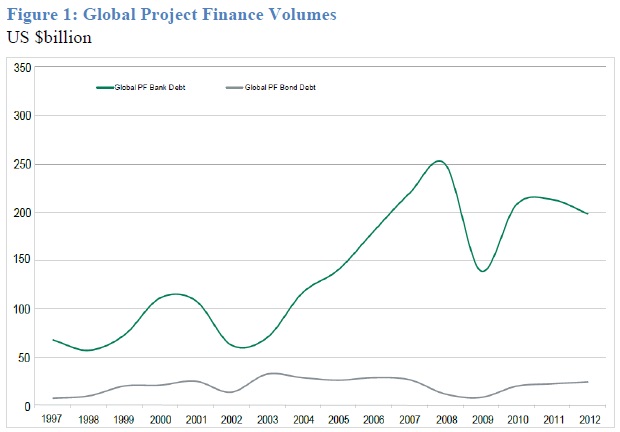

Apart from the major state-sponsored efforts in infrastructure development in China and a few other Asian countries, infrastructure development in most parts of the world has been seriously lagging over the past three decades. The initial hopes that the privatization wave of the 1980s would fuel a private-sector funded greenfield infrastructure investment boom have have fallen well short of expectations. The motivations for privatization were: i) governance; ii) incentives, and iii) budget constraints. The experience with public sector infrastructure up to the 1980s in low-income countries and advanced economies was one of large cost overruns, poor maintenance, corruption, and little positive externalities. In other words, many infrastructure projects have turned out to be white elephants. Early evidence of privatization was encouraging as it resulted in greater efficiency, better maintenance and new sources of funding, with the development of public private partnerships (PPPs). However, the most recent evidence clearly points to a relative slowdown in infrastructure development in many parts of the world (see Figure 1).

There is new hope for infrastructure development given the size of the asset under managements of long-term investors including traditional institutional investors and sovereign wealth funds in Asia and the Middle East, who are searching for longer term assets as savings vehicles. Long-term investors are relatively much better placed investing in longer term global infrastructure assets, where they are likely to face less competition, and where remarkably there is also a huge demand for funding. At a time when the world recovery from the financial crisis is still timid and public debt levels remain elevated, the provision of financing to help replace aging infrastructure in advanced economies and build brand new ones in emerging markets could contribute to reignite their economic engines.

While there are opportunities, there are also important bottlenecks including on financing and origination of infrastructure projects. Recent attempts to remove or circumvent these bottlenecks point to the need to take stock of those initiatives including investment platforms and to go further and critically discuss what the emerging landscape of private-public coinvestment in infrastructure will be. This paper aims to shed light into what that new model could be.