News

Review of Investor-State Arbitrations in 2016

UNCTAD launched its annual review of investor-State arbitrations. The IIA Issues Note reviews developments in treaty-based investor-State dispute settlement (ISDS) in 2016. It contains an overview of cases initiated in the past year, overall case outcomes and an in-depth analysis of arbitral decisions.

Highlights

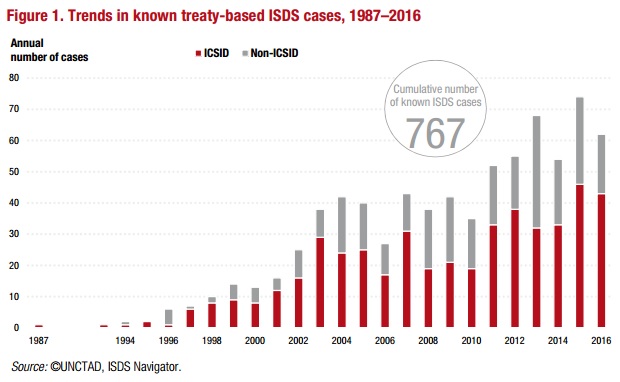

- The rate of new treaty-based investor-State dispute settlement (ISDS) cases continued unabated. In 2016, 62 new cases were initiated pursuant to international investment agreements (IIAs), bringing the total number of known cases to 767. Looking at the totality of decisions on the merits by the end of 2016, about 60 per cent were decided in favour of the investor and 40 per cent in favour of the State.

-

The new ISDS cases in 2016 were commenced against 41 countries. With four cases each, Colombia, India and Spain were the most frequent respondents. Developed-country investors brought most of the 62 known cases in 2016. Investors from the Netherlands and the United States initiated the most cases with 10 each, followed by investors from the United Kingdom with 7.

-

About two thirds of ISDS cases in 2016 were brought under bilateral investment treaties (BITs), most of them dating back to the 1980s and 1990s. The remaining arbitrations were based on treaties with investment provisions (TIPs). The IIAs most frequently invoked in 2016 were the Energy Charter Treaty (ECT) (with 10 cases), the North American Free Trade Agreement (NAFTA) and the Russian Federation-Ukraine BIT (3 each).

-

In 2016, ISDS tribunals rendered at least 57 substantive decisions, 41 of which are in the public domain (at the time of writing). Of these public decisions, half of the decisions on jurisdictional issues were decided in favour of the State, whereas those on the merits were mostly decided in favour of the investor.

-

In the past year’s decisions tribunals considered many issues that touched upon topics identified in UNCTAD’s Road Map for IIA Reform (WIR15) and its Investment Policy Framework for Sustainable Development (UNCTAD, 2015). For instance, tribunals addressed the right to regulate to protect public health under the fair and equitable treatment (FET) and indirect expropriation clauses (Philip Morris v. Uruguay), the limitation period for bringing ISDS claims (Berkowitz and others v. Costa Rica), a State counterclaim concerning the investors’ alleged violation of human rights (Urbaser and CABB v. Argentina), and the interpretation of the most-favoured-nation (MFN) clause in IIAs (Içkale v. Turkmenistan) as well as in the WTO General Agreement on Trade in Services (GATS) (MMEA and AHSI v. Senegal).

-

The wording of specific treaty provisions is a key factor in case outcomes, underlining the importance of balanced and careful treaty drafting. This not only applies to future treaties, but also calls for modernizing the existing stock of old-generation treaties. UNCTAD’s World Investment Report 2017 presents and analyses the pros and cons of 10 policy options that countries can take to reform their old-generation treaties (chapter III, WIR17).