News

How can Africa kill the red tape and improve trade?

“There are so many processes, so much documentation. A centralized place of clearance could solve anything.” These are the words of Sharon Kimanini, head of logistics for a Kenyan garment exporter. Her message is clear.

As the Global Enabling Trade Report 2016 points out, improving the efficiency of process and reducing the red tape around cross-border trade remains an easy win for international trade. While progress on multilateral trade talks looks dim and overall infrastructure investment lags, focusing on regulatory efficiency can help governments enable trade quickly, doing more with less.

According to UNCTAD and OECD estimates, the implementation of the WTO Trade Facilitation Agreement costs between $4 to $20 million per country, while the impact on exports, and hence jobs, would be many times greater. The WTO estimates it could boost developing country exports by up to $730 billion per year.

A number of countries across Africa have made important strides on the efficiency front.

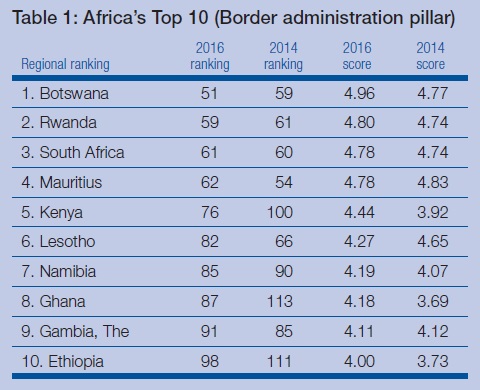

Botswana leads the region on the Enabling Trade Index’s border administration pillar, seen below. Its compliance with import procedures requires only eight hours on average, on a par with major global traders such as South Korea and the United States. On the cost side, Kenya has managed to radically cut the price of import compliance, from an average of $550 to $115 per container. These types of efficiency drivers – reducing time and cost for red tape – are critical when it comes to enabling trade, especially for small and medium-size companies, which often face the most significant hurdles.

However, more needs to be done. Governments must work hand-in-hand with the private sector to identify key bottlenecks and agree on ambitious roadmaps for reform. Governments must also coordinate with regional counterparts to ensure coherent and coordinated implementation, which can support regional integration, including those at the continental level, such as the African Union’s Boosting Intra-African Trade agenda. These reforms can also help to better position economies as attractive destinations for foreign investment, particularly as manufacturing opportunities open up with increasing costs in Asia.

The Global Alliance for Trade Facilitation is engaging with companies, government agencies and private-sector organizations in Ghana and Kenya to support this critical joint process, and plans to explore future partnerships with other countries in the region in 2017.

From speaking with traders such as Sharon Kimanini, it appears there are a number of concrete solutions that can address these bottlenecks. Although these solutions may not call for big financial investments, they will require champions from both government and business to ensure they are fit for purpose and sustainable. With momentum picking up with the imminent entry into force of the Trade Facilitation Agreement, we look forward to seeing continued progress and finding out which economies will lead the way in 2018, when the next Enabling Trade Index comes out.

Key message: Harvest that low-hanging fruit

Among the myriad measures to enable trade, reforming border administration deserves special attention. It requires little money and can be done relatively quickly. OECD estimates that implementation of the Trade Facilitation Agreement (TFA) would require between $4 to $20 million by country, on average, with fairly low direct annual operating costs. UNCTAD’s cost analysis echoes the OECD’s, and finds that three quarters (28 out of 37) of TFA measures would require, on average, three years or less for implementation, with the remaining measures needing five years or less. Furthermore, reforms in this area are mostly uncontroversial and therefore require only limited political capital, as confirmed by the adoption of the Trade Facilitation Agreement in 2014 amid a very difficult international context. Moreover, proposed TFA reforms can support government revenue collection and provide a boost for business. Significantly, they can mostly be done unilaterally, although some aspects require international cooperation (e.g. in matter of transit). Finally, adoption of the TFA, and its upcoming entry into force – most likely in 2017 – provides not only momentum for reforms, but also resources to developing countries to help them implement the Agreement. Yet, reforming border administration is not an easy task and therefore requires strong political and bureaucratic will; close cooperation among a myriad agencies, bodies and actors; and, sometimes, direct assistance.

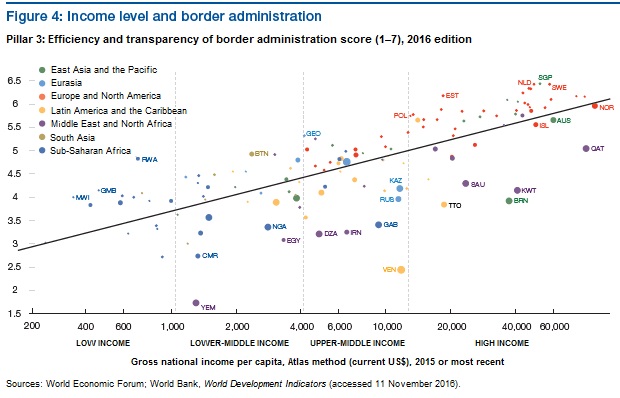

The combination of political feasibility, affordability, promises of additional revenues, momentum and resource availability suggests that border administration is the low-hanging fruit of trade facilitation. Yet the ETI results show that the potential of streamlining border administration remains largely untapped. Trade-enabling performance remains strongly correlated to the level of development (Figure 4). Worse, there has been no sign of convergence among development levels since 2014. In fact, the gap between developing and advanced economies has actually widened by 0.1 points from 1.22 to 1.32 on a 1-to-7 scale. Yet, there are some bright exceptions, notably in Sub-Saharan Africa (see Trade facilitation performance in Africa below).

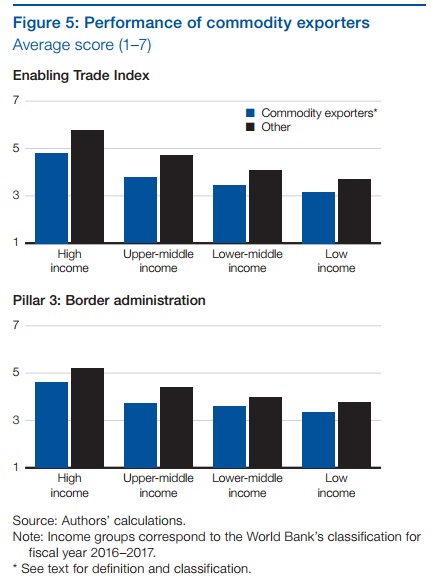

Conversely, the performance of commodity exporters is particularly mediocre: the vast majority of them trail their respective peer income groups by a wide margin. Among high-income economies, for instance, the average score of commodity-rich countries on the third pillar is one full point lower than the average score of other countries in that income group (see Figure 5). In light of these results and in a prolonged episode of low commodity prices, the fact that improved trade facilitation, and in particular improved customs efficiency, is associated with higher export diversification bears particular significance.

From a practical standpoint, improving border administration consists to a large extent of improving policies and regulations, although it also requires adopting or upgrading IT infrastructure, building capacity, and additional investment. The success of TFA implementation will be measured in terms of the existence of adequate regulation on matters such as information availability, formalities, advance rulings, appeal procedures, fees and charges. Currently, the best information on the state of implementation of the TFA is compiled by the OECD, using proprietary data and other sources, including the Global Expression Association. However, the OECD indicators provide little information about the actual enforcement of the regulations, let alone their effectiveness, which is what ultimately matters.

This distinction between the de jure and the de facto is still difficult to establish, precisely due to the lack of indicators about the latter. This is the gap that the Global Alliance for Trade Facilitation’s work on data aims to fill. Already the results of the World Economic Forum’s Executive Opinion Survey (EOS) suggest that good regulation does not imply good performance. Figure 6 shows the positive, but very loose relationship between the level of customs services and the perceived efficiency of customs (6a), and slightly closer relationship between customs transparency and perceived bribery in customs (6b). In fact, many countries achieve the maximum score of 1 for regulatory transparency, including Nigeria, which has earned the worst score–1.9 on a 1-to-7-scale–on the bribery indicator (derived from the EOS) among the 136 economies included in the ETI. It is difficult to establish whether this disconnect is due to a lack of enforcement of transparency rules, the lack of anti-graft rules, or both, but it is a cautionary tale.

Trade facilitation performance in Africa

Although Sub-Saharan Africa remains, on average, one of the weaker performing regions on the Border administration pillar, a number of countries in the region are making progress to facilitate trade. Botswana and Rwanda, two small landlocked countries, have become the top performers in this pillar for 2016, taking over from Mauritius and South Africa, with Kenya rounding out the top 5.

Documentation and border clearance for imports into Botswana requires only eight hours on average, on par with South Korea and the United States. On the export side, compliance times are longer, though still performing above the global average. In 2016, Botswana launched its national Trade Portal, providing a streamlined online platform for access to all necessary information on import and export procedures.

Rwanda, with an annual GDP per capita of just $500, has invested significantly in improving its border procedures, including through the implementation of the electronic single window system. The Rwanda ESW has helped to cut the cost of border clearance dramatically, thereby reducing costs for trade. At the same time, businesses surveyed report low levels of irregular payments, while rating the time predictability of import procedures as high.

Neighboring Kenya recorded an over 70 percent reduction in the cost of import documentation clearance (from $550 to $115) in 2016, while the cost of border clearance remains relatively high. Similarly, in the overall perceptions of the efficiency of the clearance process as measured by the World Bank’s Logistics Performance Index, Kenya has improved dramatically among countries in the ETI dataset (from 128th to 39th). Here, too, the single window has been an important component, although the prevalence of irregular payments remains a concern.

Two additional significant improvers are Ghana (8th) and Ethiopia (10th). Ghana, an economy hit by macroeconomic and foreign exchange shocks in 2015, significantly reduced the time required for border and documentation compliance by two-thirds. Time and cost for border compliance in Ethiopia are high, but it has made significant improvements in the Time predictability of procedures according to businesses surveyed, moving from 125th to 77th on this indicator.