News

Global FDI to fall 10-15% in 2016, road to recovery looks bumpy

Global FDI flows are expected to drop to between $1.5 and $1.6 trillion in 2016, a fall of 10% to 15% from 2015, before recovering in 2017 and 2018, according to estimates from UNCTAD’s latest Global Investment Trends Monitor.

FDI flows have been volatile in recent years, with analysts warning that this uncertainty will have its own negative impact on trade and global value chains. In the meantime, the road to the recovery of global FDI looks rocky, UNCTAD Secretary-General Mukhisa Kituyi said.

“This drop in FDI is troubling, because our global economy urgently needs investment to get it going again,” Dr. Kituyi said.

The latest data support estimates that FDI flows are falling, a forecast made last June in the World Investment Report. Declining FDI reflects the fragility of the global economy, the persistent weakness of aggregate demand, sluggish growth in some commodity exporting countries, and a slump in the profits of some multinational enterprises (MNE) in 2015.

“We forecast FDI to pick up in 2017, then to reach $1.8 trillion in 2018, but it will remain lower than the pre-crisis peak,” Dr. Kituyi said.

One striking aspect of the analysis is the diversity between the different regions. In Africa, FDI inflows are likely to return to growth in 2016. And after steep falls for the past three years, FDI flows into transition economies are expected to increase modestly too. But in developing Asia and in Latin America and the Caribbean, FDI is expected to decline. In developed economies, FDI grew sharply in 2015, but this growth is not expected to last in 2016.

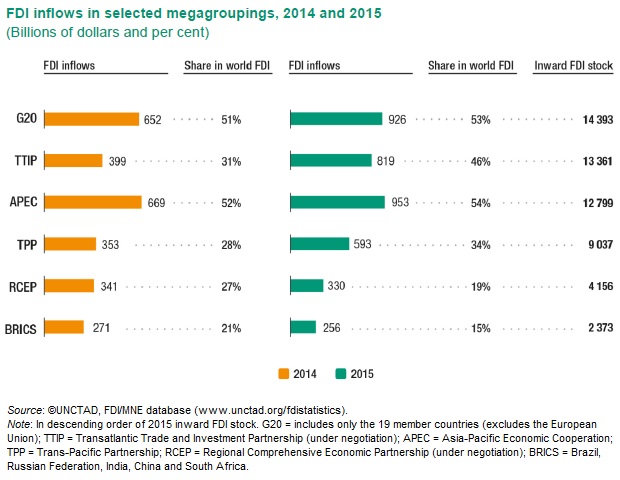

This diversity holds true for mega-groupings too. For G20 countries, UNCTAD forecasts a fall in FDI flows of between 5 and 10% in 2016. APEC members are also expected to see FDI fall by 15 to 20%. However, BRICS countries could see FDI return to growth, increasing some 10%.

Overall, expectations about short term FDI flows are best described as mildly pessimistic. FDI will decline in both developing and developed countries.

Global Investment Prospects Assessment 2016-2018

Key factors influencing future FDI

Global FDI inflows are expected to decline by 10-15 per cent in 2016, reflecting the fragility of the global economy, persistent weakness of aggregate demand, effective policy measures to curb tax inversion deals and a slump in MNE profits. Elevated geopolitical risks and regional tensions could further amplify the expected downturn. FDI flows are likely to decline in both developed and developing economies. Over the medium term, global FDI flows are projected to resume growth in 2017 and to surpass $1.8 trillion in 2018.

The world economy continues to face major headwinds, which are unlikely to ease in the near term. Global GDP is expected to expand by only 2.4 per cent, the same relatively low rate as in 2015. A tumultuous start to 2016 in global commodity and financial markets, added to the continuing drop in oil prices, have increased economic risks in many parts of the world. The momentum of growth slowed significantly in some large developed economies towards the end of 2015. In developing economies, sluggish aggregate demand, low commodity prices, mounting fiscal and current account imbalances and policy tightening have further dampened the growth prospects of many commodity-exporting economies. Elevated geopolitical risks, regional tensions and weather-related shocks could further amplify the expected downturn.

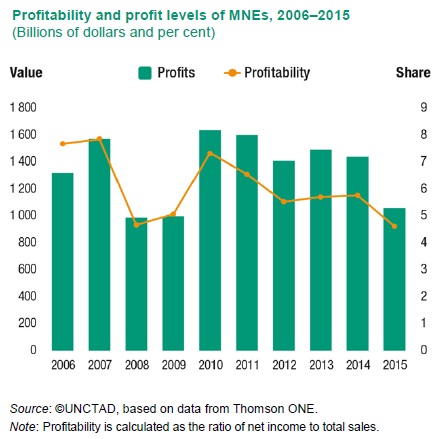

The global economic outlook and lower commodity prices has had a direct effect on the profits and profitability of MNEs, especially in extractive industries. After two years of increase, profits of the largest 5,000 MNEs slumped in 2015 to the lowest level since the global economic and financial crisis of 2008-2009.

The value of announced cross-border deals may be less affected than in recent years by purely tax-driven deals, as the United States Treasury Department imposed new measures to rein in corporate inversions in April 2016. The new rules, the Government’s third wave of administrative action against inversions, make it harder for companies to move their tax domiciles out of the United States and then shift profits to low-tax countries. As a result, the $160 billion merger of pharmaceutical company Pfizer (United States) with Ireland-based Allergan Plc was cancelled.

Over the medium term FDI flows are projected to resume growth in 2017 and surpass $1.8 trillion in 2018, reflecting the projected increase in global growth.

FDI prospects in megagroupings

Megagroupings such as the G20, the TTIP, Asia-Pacific Economic Cooperation (APEC), the TPP, the RCEP and the BRICS account for a significant share of global FDI.

The economic collaboration in megagroupings is raising expectations of higher future FDI flows into these groups from intra-regional and extra-regional sources. The prospect of a large regional market, liberalization, removal of tariff barriers and complementarity of locational advantages are expected to encourage companies from inside and outside each grouping to establish a stronger presence. Megagroupings are expected to increase opportunities for market-seeking, resource-seeking and efficiency-seeking FDI and to lead to an evolving investment environment that will influence greater intra-economic group value chain activity. However, as inflows to megagroupings are currently highly concentrated, their short-term FDI prospects will continue to be influenced by few large economies.

Regional FDI prospects

Africa

FDI inflows to Africa could return to a growth path in 2016, increasing by an average of 6 per cent to $55-60 billion. This bounce-back is already becoming visible in announced greenfield projects in Africa. In the first quarter of 2016, their value was $29 billion, 25 per cent higher than the same period in 2015. The biggest rise in prospective investments are in North African economies such as Egypt and Morocco, but a more optimistic scenario also prevails more widely, for example in Mozambique, Ethiopia, Rwanda and the United Republic of Tanzania.

Depressed conditions in oil and gas and in mining continue to weigh significantly on GDP growth and investment across Africa. The rise in FDI inflows, judging by 2015 announcements, will mostly occur in services (electricity, gas and water, construction, and transport primarily), followed by manufacturing industries, such as food and beverages and motor vehicles. MNEs are indeed showing great interest in the African auto industry, with announced greenfield capital expenditure into the industry amounting to $3.1 billion in 2015. Investment into Africa’s auto industry is driven by industrial policies in countries such as Morocco, growing urban consumer markets, improved infrastructure, and favourable trade agreements. Major automotive firms are expected to continue to expand into Africa: PSA Peugeot-Citroen and Renault (France) and Ford (United States) have all announced investments in Morocco; Volkswagen and BMW (Germany) in South Africa; Honda (Japan) in Nigeria; Toyota (Japan) in Kenya; and Nissan (Japan) in Egypt.

To reduce the vulnerability of Africa to commodity price developments, countries are reviewing policies to support FDI into the manufacturing sector. East Africa has already become more attractive in this sector as a source and investment location, especially in light manufacturing. MNEs are therefore investing across Africa for market-seeking and efficiency-seeking reasons. Proximity can be beneficial, so Bahrain, France, Italy, the United Arab Emirates and the United Kingdom remain prominent as investors; but closeness to major markets in Europe and West Asia is also attracting export-oriented investors from East, South and South-East Asia, which are focusing on locations in North and East Africa such as Ethiopia.

Liberalization of investment regimes and privatization of State-owned commodity assets should also provide a boost to inflows. In Algeria, for example, Sonatrach SPA, the State-owned oil and gas company, intends to sell its interest in 20 oil and gas fields located in the country. Similarly, in Zambia, the Government is bundling State-owned businesses into a holding company and trying to attract foreign buyers. Other liberalization measures include the removal of further restrictions on foreign investments in most African countries. Kenya has moved to abolish restrictions on foreign shareholding in listed companies as competition for capital heats up among Africa’s top capital markets. The move comes just a year after the United Republic of Tanzania lifted a 60 per cent restriction on foreign ownership of listed companies, permitting full foreign control.