News

IMF Executive Board 2016 Article IV Consultation with Ethiopia

On September 26, 2016, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Ethiopia.

Ethiopia’s macroeconomic outturn during the past year 2015/16 has been adversely affected by a severe drought and the weak global environment. As a result, output growth is estimated to have slowed down in 2015/16 to 6.5 percent. The slowdown was mitigated by effective and timely policy responses to the drought, and buoyant industrial and services sectors. Stability-oriented macroeconomic policies, including drought-related food imports, curbed inflationary pressures, with overall inflation receding to 6 percent in July 2016. A supplementary budget helped address the social costs of the drought, while keeping the general government deficit at 3 percent of GDP. However, the external current account deficit, estimated at 10.7 percent of GDP, remained wide.

Export revenue stagnated due to weak international commodity prices, despite increases in export volumes and diversification to new export markets. Savings on fuel imports were more than offset by increased drought-related food imports and other imports. Remittances and FDI posted strong growth, helping to limit the deterioration of the external position. The foreign reserve buffer is less than 2 months of import coverage. The 2015/16 foreign borrowing requirement of the non-financial public sector is estimated at 5 percent of GDP, a significant reduction compared to the recent past. Public and publicly-guaranteed debt is estimated to have been 54.2 percent of GDP in June 2016, of which 30.2 percent of GDP corresponds to external debt.

Over the medium-term, growth is projected to recover to within the 7.3-7.5 percent range, reflecting the growth-oriented reforms envisaged in the recently adopted second Growth and Transformation Plan (GTP II). Public investment is projected to moderate, while private investment is projected to increase gradually, aided by better access to credit and anticipated improvements in competitiveness. Inflation is projected to remain at around 8 percent, consistent with the authorities’ price stability objective, supported by supply expansion and the monetary policy stance. The general government deficit is envisaged to hover at around 3 percent of GDP, with expenditure policies focused on capital and poverty-reducing programs. Export revenue is forecast to expand throughout the medium-term, underpinned by more stable commodity prices, competitiveness gains on account of key ongoing projects in logistic infrastructure, and greenfield FDI. Import growth is projected to remain robust and the current account deficit is projected to remain high, declining gradually over time.

Staff Report

Recent economic developments

In October 2015, Ethiopia's authorities launched the second five-year Growth and Transformation Plan (GTP II), setting medium-term economic and social policy priorities (Annex IV). Ethiopia has had an impressive track record of growth and poverty reduction in recent years, with GDP growth averaging 10.1 percent in 2010/11-2014/15,4 about 8 percent GDP per capita growth. Poverty has declined markedly and inequality, with a Gini index of 30 percent, is low by international and Sub-Saharan Africa (SSA) standards. However, income per capita is still low at US$590, only slightly over one-third of the SSA average. The key GTP II goal is for Ethiopia to become a lower middle-income country by 2025, through average annual real growth of 11 percent in 2015/16-2019/20. While the public sector will continue playing an important role, the GTP II places a key emphasis on private sector development and FDI, particularly in building an export-oriented manufacturing sector. As in past national plans, growth targets are underpinned by envisaged rapid structural transformation and investments in energy generation, transportation, and infrastructure to boost productivity and competitiveness.

The Ethiopian economy coped well with a difficult 2015/16 year, when the country faced two adverse exogenous shocks. Overall economic growth is estimated at 6.5 percent, placing Ethiopia once again among the world’s fast-growing economies. This strong growth performance represents, however, a slowdown relative to last year due to the impact of the “El Niño”-related drought and a drastically weaker global environment, epitomized by the near 12 percent fall in the U.S. dollar value of world merchandise trade in 2015.

Targeted policies, buoyant industrial and service sectors, and increased agriculture resilience, helped to maintain growth momentum. Official data including the Central Statistical Agency (CSA) crop production survey estimate an increase in grain production by 2.9 percent in 2015/16 (versus 7.5 percent in 2014/15), while other sources had pointed to a less favorable outcome. While the drought spared most export crops and mainly affected low-productivity regions, the social costs were large. Timely government interventions and food aid, coupled with improved agricultural practices, technology, and rural infrastructure, appear to have limited the economic impact of the drought relative to earlier drought episodes, including by helping to increase production in less-affected areas. Indirect indicators point to strong growth in industry (particularly construction and manufacturing) and services (notably trade, freight and passenger transportation, telecoms, tourism and hospitality, and financial intermediation).

The current account gap remained wide, owing to a weak external environment and imports of drought-related food, inputs, and capital goods – despite lower fuel import costs. The current account deficit is estimated (as of July 2016) at about US$7.4 billion (10.7 percent of GDP), broadly unchanged in U.S. dollars from last year. Export revenue stagnated as significant merchandise export volume growth (7.7 percent) was offset by sharp declines in Ethiopia’s export prices (16 percent for coffee, 33 percent for oil seeds, and 6 percent for gold). Import savings from lower fuel prices were more than offset by drought-related food, inputs and capital goods imports. Remittances posted strong growth (28 percent), as did FDI (44½ percent). The foreign reserve cushion, at 1.9 months of imports at end-June 2016 (unchanged from previous year), remains thin.

Inflationary pressure was contained by imports and cross-regional redistribution of domestic market purchases of foodstuffs – supported by a restrictive monetary policy stance. From an 11.9 percent peak in September 2015, headline inflation receded to 7.5 percent by June 2016, and 6 percent in July – in line with the National Bank of Ethiopia (NBE) inflation objective, driven by food price moderation. Base money grew broadly in line with the NBE target of 16 percent, despite a recent increase in net credit to the government, and the growth of credit to the non-government sectors moderated since December 2015. The NBE acquired a US$1 billion external liability by end-2015, which eased foreign exchange availability, financed increasing food and other imports, and temporarily boosted reserves. Financial intermediation has continued to advance at a fast clip with a 25 percent annual growth of bank deposits, supported by a 19 percent increase in bank branches (in the 12 months to December 2015).

The fiscal stance was appropriately supportive, aiming at minimizing the economic and social impact of the drought. Tax revenue collection of the federal government is expected to be broadly in line with the annual budget plan, benefiting from good execution of direct and import taxes, while falling short in domestic VAT collection. On the spending side, the supplementary budget approved in December 2015 contained appropriations for food security, agriculture, and investments – funded by Oil Stabilization Fund surpluses (reflecting a limited pass-through of lower fuel import costs into domestic prices). The general government deficit is estimated at 3 percent of GDP. The total borrowing requirement of the non-financial public sector represented about 5 percent of GDP, a significant decline relative to recent years.

Policy implementation was consistent with outstanding Fund advice in some areas, but less so in others. Notably, the GTP II incorporates a focus on competitiveness, private sector development and FDI. The new Public-Private Partnerships (PPPs) legal and regulatory framework reform and Small and Medium Enterprises (SMEs) financing schemes will support private sector participation. The newly established Ministry of Public Enterprises’ mandate for improved governance, and tax system reforms will strengthen public sector efficiency. Fiscal and monetary policies remained consistent with macroeconomic stability. However, Fund recommendations on interest rates, exchange rate, and financial sector policies are yet to gain momentum, including: (i) allowing for flexible determination of the interest rates, (ii) improving market functioning and price setting mechanism for the exchange rate and increase exchange rate flexibility, and (iii) phasing out the requirement that private banks invest in NBE bonds a 27 percent of their credit (to finance the Development Bank, DBE). Follow up on technical assistance (TA) recommendations to improve data quality and coverage has been mixed.

Medium-term outlook and risks

Growth is expected to rebound to 7.5 percent in 2016/17, as the weather-dependent agriculture normalizes, and remain at this level over the medium term, supported by strong GTP II growth-oriented reforms. Inflation is projected to hover around 8 percent through the medium term, buttressed by more stable commodity prices and an appropriate monetary policy stance. Exports of goods and services should pick up substantially in the medium term from the current low base, reflecting the coming online of key infrastructure projects close to completion (in electricity generation and export logistics) and pay-offs from domestic investment and greenfield FDI. Import growth will remain moderate in 2016/17 as emergency food imports are phased out, but is likely to be strong thereafter, as waning public import-intensive investment is replaced by private sector imports. Thus, the current account deficit is projected to remain high and decline only gradually in the medium term.

Against a generally positive outlook, the high current account deficit and a potential export under-performance (should adverse global conditions prove protracted) are the key downside risks (Box 1). Additional external demand weakness and upturns in global risk aversion could hinder the current account improvement and financing, and hence output and debt sustainability. However, the risk of disorderly external stress episodes is mitigated by the high proportion of official bilateral and multilateral external debt (much of it concessional), a closed financial account, and the use of the borrowed funds for export-enhancing investment projects with expected high returns – increasing repayment capacity. On this basis, and assuming no further borrowing beyond existing plans, the Debt Sustainability Analysis (DSA) currently assesses the risk of debt distress at moderate, but the extended large breach of the debt to export ratio is of increasing concern. Over the medium-term, financing constraints on private sector development, weak export growth, slow implementation of revenue mobilization reforms, potential deterioration of bank assets quality in the wake of rapid credit growth and higher pace in acquisition of external liabilities are the main risks. Ethiopia remains vulnerable to climate change and droughts.

Box 1. Ethiopia: Investing for Development

The marginal product of public capital in Ethiopia is above most peers, but the increasing relative scarcity of private capital calls for private sector development. Based on staff panel estimations of Cobb-Douglas production functions using data from IMF and WEO databases, and the Penn World Table, the marginal product of public capital (0.42) in Ethiopia is significantly larger than the median of LICs (0.18) – consistent with a relatively good Public Investment Management Index. Large public investments during more than a decade, however, have made private capital comparatively scarce, raising its marginal product and supporting the GTP II new focus on eliciting private investment and FDI.

Model-based estimates point to large growth effects of infrastructure investment. A version of the open-economy Debt, Investment, and Growth (DIG) model developed by Buffie et al. (2012), has been calibrated to the Ethiopian economy. The model simulates the public investment under the GTP II and ascertain the approximate size and time profile of their effects on growth, current account, private investment and debt. An alternative and more cautious investment path could result in more sustainable outcomes – less crowding out of private investment and consumption and lower current account deficit and public debt – with longterm gains in growth and consumption preserved. Decelerating public investment could help Ethiopia to cope with the short-term challenges associated to external imbalances and GTP II financing requirements. The model also highlights the importance of efficiency in public investment implementation and the risks of surges in the cost of external financing.

Authorities’ views

The authorities estimated growth in 2015/16 and medium-term output and export growth potential higher than staff. The authorities emphasized rising export volumes, completion of key infrastructure projects, notably in energy generation and transportation, and measures to elicit export-oriented FDI, including commitments by international businesses to locate in the new industrial zones. In their view, these factors argued for two-digit medium-term growth potential, supported by export revenue growth of 32 percent in 2016/17 and about 17 percent subsequently, and continued strong remittances and FDI. Nonetheless, while seeing less downside risks than staff, the authorities concurred on the need to reduce the external deficit; take measures to ensure debt sustainability, consistent with the DSA moderate rating; and, should external revenue disappoint, adopt import-dampening policies.

Policies for resilient growth

Despite sustained growth, the bottleneck of the Ethiopian economy remains its large savings-investment gap and associated external borrowing requirement. The current account deficit of the last two years, at about 7½ billion dollars and over 10 percent of GDP, is not sustainable. In the short term, macroeconomic policies should be geared towards reducing the external current account deficit and its attendant risks. To this end, the authorities’ objective of rapidly rising exports is the first best option. However, at the same time, imports and large-scale public investment projects with substantial external borrowing requirements need to be paced according to the actual export performance. Specifically, public sector imports need to be curbed in the short term aiming at reducing demand for external credit. This would allow building up the foreign reserve buffer and avoid volatility in foreign exchange availability. Reaching the authorities’ ambitious five-year GTP II growth objectives and sustained investment rates of almost 40 percent of GDP without aggravating external imbalances will require mobilizing domestic resources and raising domestic savings, particularly in the public sector – the main user of external borrowing.

In the medium- and long-term horizon, mobilizing and attracting domestic and foreign private sector resources, as envisaged in the GTP II, will require challenging reforms. After strong public sector-led growth under the GTP I, the authorities’ objectives for the current phase of Ethiopia’s economic development call for manufacturing expansion accompanied by rapid improvements in competitiveness, economic diversification, and the investment and business climate. This, in turn, requires fostering market competition within an increasing number of economic areas, including financial, credit, and investment markets; and expanding the allocation of resources to the private sector, such as credit and foreign exchange. It also requires increasing the efficiency and transparency of the public sector, including the tax system, public financial management processes, and public enterprise governance and financial management. Important steps in this direction, guided by the GTP II, are already in train – but will need to be scaled up and sustained.

A. Fiscal Policy

The budgetary policy stance has been broadly appropriate, in response to the drought-related needs; however, curbing the external deficit will require tighter policies going forward. The relatively expansionary fiscal policy stance in recent months was appropriate to mitigate the transitory agricultural supply shock, associated adverse hysteresis effects, and spillovers to the rest of the economy; and to minimize social costs. However, fiscal expenditure restraint in the implementation of the 2016/17 budget, including under-execution of nonessential lines, and subsequent years should take priority as supply improves, aiming at curbing the public borrowing requirement. The de facto fiscal anchor is the budget deficit, which the authorities target at about 3 percent of GDP over the medium term. However, reducing external imbalances and shifting savings and financing resources to private sector development would be aided by a gradual reduction of the fiscal deficit from its current level by about ½ percentage point of GDP per year over the medium term, underpinned by revenue expansion.

Decisive tax reforms are needed to support the ambitious GTP II targets for revenue mobilization. The recently passed income tax law simplifies procedures, updates tax brackets, and improves the tax appeals process. Also, the newly introduced invoice-based taxation of imports is an important step in modernizing customs procedures and trade facilitation. However, achieving the GTP II objective of over 17 percent tax-to-GDP ratio by 2019/20 necessitates additional tax policy reforms, including the introduction of a property tax and review of existing tax expenditures and incentives. Property taxes have low distortive effects and, if allocated to sub-national levels of government, would reduce intergovernmental transfers. Annual review of tax expenditures would allow phasing out those that are no longer cost-effective, while reducing tax complexity and the accumulation of tax loopholes. Regarding tax administration, measures need to focus on improving taxpayer coverage and enforcement, including by updating and maintaining the taxpayer register; using risk-based compliance monitoring; and improving IT systems, data quality, and their use.

Prioritizing public investment, while protecting pro-poor outlays, would enhance fiscal sustainability and efficiency. Given limited resources, public expenditure policy should focus on critical infrastructure and priority areas. Ongoing reforms of the PPPs legal framework provide an opportunity to improve public sector efficiency and private sector development, while attracting foreign resources. The envisaged new PPP framework, however, should be based on cost-benefit analysis and minimize fiscal risk.

Comprehensive and upgraded fiscal reporting would support macroeconomic management and accountability. Upgrading government accounting to 2001 Government Finance Statistics Manual (GFSM) standards is an urgent task. Policymaking as well as public understanding of policies would benefit from more comprehensive fiscal reporting covering budgetary institutions jointly with extra-budgetary accounts (such as the Oil Stabilization Fund, Privatization Fund, Industrial Development Fund, Road Fund, and use of Eurobond proceeds).

B. Monetary and Financial Sector Policies

A more flexible monetary policy framework would facilitate policy implementation. The NBE uses reserve money, foreign exchange sales, and other direct monetary policy instruments with a view to keeping inflation near 8 percent. The NBE is considering revamping the primary market and introducing a secondary market for government securities – and eventually, possibly for other instruments – to develop interbank market operations. These initiatives and an increased role of indirect monetary policy instruments could substantially benefit policy implementation and liquidity management. They could encourage commercial banks to manage more actively their liquidity positions (through market transactions, rather than via direct access to the NBE’s liquidity facilities), and enhance price discovery mechanisms and risk allocation.

The authorities are making commendable progress in mobilizing domestic savings through rapid expansion of financial access and inclusion. Deposit mobilization and bank branch expansion are deepening financial intermediation and funding growth-promoting credit. The authorities’ private sector development objectives would be aided by rebalancing the public sector credit demand towards the private sector to avoid its crowding out. Also, development of market-based incentives for mobilization and allocation of savings will require positive real interest rates – facilitated by the NBE’s progress in achieving lower inflation. Efficiency and growth gains will eventually exceed the increased public sector borrowing costs. In the short term, however, higher interest rates will need to be accompanied by fiscal and public sector measures to accommodate the associated higher financing costs. The current means of financing the Development Bank (DBE) – now through banks mandatory purchases of NBE bonds – should be replaced by less distortive mechanisms, including through the budget.

A sound financial sector is critical for the mobilization and efficient allocation of savings. Aggregate capital and profitability ratios of commercial banks do not indicate emerging vulnerabilities; and the system-wide NPL ratio remains low, below the statutory benchmark of 5 percent – although the lack of underlying detailed bank data preclude the assessment of individual bank vulnerabilities. There have occurred sporadic liquidity shortages, and the aggregate liquidity ratio is now close to the statutory minimum of 15 percent. While the rapid pace of financial deepening is welcome, strengthening the supervisory and regulatory environment is necessary to ensure that lending standards do not deteriorate. Risks related to credit exposures and their concentration should be assessed through regular stress-testing of commercial banks’ balance sheets. Although not a deposit-taking institution, the ongoing supervisory attention to high NPL ratios in the DBE is warranted – since it could affect confidence or become a fiscal liability. Strengthening the AML/CFT framework, in line with the Financial Action Task Force standard, will also contribute to the soundness of the financial sector.

C. Fostering Competitiveness through Structural Transformation

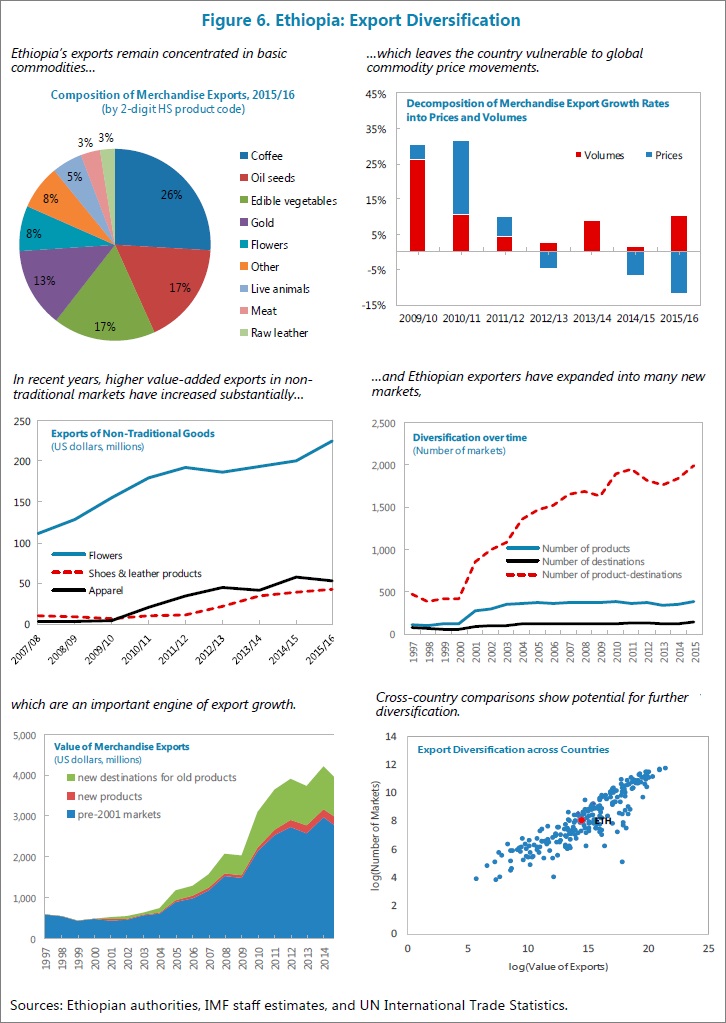

Export diversification and upward shifts in the value-added chain are key items in the authorities’ reform agenda. Nascent export lines (leather, apparel, textile, flowers, electricity) and expansion to new markets point to good prospects, supported by substantial cost differentials. However, export revenue still depends heavily on commodities, hindering income growth and amplifying volatility. Ongoing policy initiatives aim at developing additional export lines with a focus on manufacturing and export-processing activities, notably with the creation of new industrial parks. These provide investors with simplified procedures, tax advantages, and preferential access to credit and foreign exchange. Eventually, however, the industrial park environment will need to be integrated more fully into the local value chain to generate all its potential of positive spillovers into the wider economy. Also, progress in reducing trade barriers and enhancing the customs’ trade facilitation role beyond industrial parks would increase competitiveness. The authorities are also launching other regulatory and administrative reforms aiming at improving the investment environment.

An overvalued real effective exchange rate poses headwinds for exporters and understates the true economic cost of imports. Staff assess the birr to be overvalued by 20 to 40 percent (Annex III). Allowing for a more flexible exchange rate determination, aiming to gradually eliminate misalignments, would bring the real effective exchange rate in consonance with fundamentals and reduce foreign exchange market shortages.

Also, a more flexible exchange rate policy could be instrumental in developing new export lines and entering new markets (Box 2). Staff research on Ethiopia’s export dynamics, based on product-by-product disaggregated data, indicates that the (country-by-country) real exchange rate plays a crucial role in entering new markets – although significantly less so in increasing revenue from already established markets, which are mainly traditional commodities. As a consequence, the real appreciation of the Birr can pose an impediment to the emergence of a competitive manufacturing exporting sector – and more generally to the export of non-commodity products with high domestic value-added facing price competition. Thus, exchange rate policies aiming to eliminate currency misalignments could play an instrumental role in achieving the authorities’ export diversification objectives. Higher import costs for the public (and private) sector would partly have a desirable dampening effect on imports’ demand – in line with a policy to reduce external imbalances – and partly would need to be absorbed through savings in other items; and in the longer term would be compensated by growth effects.

Higher foreign reserves would enhance the resilience of the economy (Annex II). Ethiopia remains vulnerable to commodity price and weather shocks. Reducing the current account deficit and expanding foreign reserve cover – aiming to eventually reach the standard of 5-7 months of imports – would forestall potentially disorderly import compression in the event of future shocks.

The new policy agenda for public enterprises aims at streamlining the sector, improving its governance and efficiency, and raising its profitability. The centralization of public enterprise management under a newly created ministry with this mandate is a valuable first step in this direction. The authorities are encouraged to implement expeditiously their plans to focus on 10-15 key public enterprises while privatizing the rest, strengthen their financial disclosure and transparency, and manage them on a commercial basis.

Box 2. Ethiopia: Export Dynamics and Diversification

Over the past 15 years Ethiopia’s merchandise export revenue grew at 13.3 percent on average. This strong performance stems from volume expansion (15.1 percent annually), as prices decreased by 2.3 percent annually. However, export growth – both price and volume – remains highly volatile, due to concentration on agricultural commodities exposed to price and weather shocks.

To reduce export volatility and increase revenue, policies aim at diversification across products and destination countries. Also, diversification has development spillovers, as less innovative firms follow in the wake of pioneer entrants. As a result, one third of 2015 export revenue comes from markets where Ethiopia was not present 15 years ago. FDI has flowed to horticulture and light manufacturing, and nontraditional exports account for more than 10 percent of total exports. For example, flower exports expanded from US$440,000 and 5 destinations in 2004 to US$225 million and 59 destinations now.

Staff analyses, based on disaggregated trade data (UN Comtrade), throw some light on the relative impact on export sales of two competitiveness factors: structural competitiveness, as measured by five indices from the Doing Business indicator, and the real exchange rate (RER). These factors are measured by market-specific trade-weighted indices of Ethiopia’s strength versus competitors.

The results indicate that the relative quality of logistics is key in improving export performance; and that the RER significantly facilitates entry in new markets – such as the abovementioned case of flower exports. In markets where the “time it takes to export” index moved against Ethiopia (relative to competitors), exports fell significantly (first column). Similarly, the quality of Ethiopia vs. competitors’ trade logistics influences the probability of Ethiopia’s entry into new markets (third column). The RER seemingly matters little when it comes to expanding exports in existing markets (mostly commodities), but it is significant for entry into new markets (third column). Therefore, ongoing improvements in infrastructure, such as the new railway link to Djibouti harbor, are likely to boost exports. But also, Ethiopia could gain a foothold in new products and markets by reducing the substantial real exchange rate misalignment.

Alternative Scenario

Implementation of staff’s recommended policies could reduce Ethiopia’s external vulnerabilities and ease financing constraints, while at the same time support achievement of sustainable long-term growth. The implications of these policies would be: (i) a lower current account deficit and a stronger exports performance, owing to timely implemented structural reforms and measures aimed at fostering external competitiveness, including exchange rate flexibility; (ii) a more sustainable debt trajectory, as a result of spreading out low-return large-scale investments over time and reducing State Owned Enterprises’ (SOEs) borrowing requirements; (iii) higher foreign exchange reserves, thus reducing volatility in foreign exchange availability; (iv) higher tax revenue, with a view to closing the fiscal gap in the medium term; and (v) stronger domestic savings with a view to narrowing the savings-investment gap, and larger accumulation of financing for investment in the long term – facilitated by higher real interest rates. The growth trajectory will be lower initially (reflecting slower imports of capital goods), but higher in the medium run, as macroeconomic stability will be enhanced, and mobilization of domestic resources improved. It would also minimize the risk of externally-induced economic stress episodes. This is consistent with staff research (Box 1) indicating the need to elicit private investment and the positive role that a moderation in the pace of public investment could play in this regard.

The authorities envisage a substantially faster export and output expansion. Correspondingly, their assessment of future imbalances and associated risks to the baseline is more subdued that staff’s. They agreed on the need to reduce the current account deficit in the short term – mainly through the expected export expansion – as well as on policies to mobilize domestic resources and foster competitiveness and private investment. They also concurred, however, that in a hypothetical scenario of protracted progress in export gains, policies to re-profile import demand would be considered.