News

Reserve Bank of Zimbabwe: 2016 Mid-Term Monetary Policy Statement

Walk The Talk to Restore Trust and Confidence

Background and Context

This Mid-Term Monetary Policy Statement is issued in terms of Section 46 of the Reserve Bank Act (Chapter 22:15). The major objectives of this Statement are to highlight the global and domestic financial developments; to provide an assessment of the monetary policy measures taken by the Bank in May 2016 to stabilize the economy; to present new measures to restore confidence within the economy; and to offer policy advice to deal with the fiscal and current account deficits in order to change Zimbabwe’s economic narrative to production and productivity which is very vital or imperative to restore trust and confidence within the national economy.

The policy measures presented in this Statement are designed to augment the measures taken by the Bank in May 2016. The new measures include the elimination of administrative hurdles of contracting offshore loans, resuscitation of the credit guarantee scheme to enhance local production by small to medium scale enterprises, putting in place nostro stabilization facilities to deal with delays in the remittance of outgoing foreign payments, promotion of internal devaluation using market-based mechanisms to restore competitiveness in the national economy, and encouraging the fast-track elimination of bottlenecks that are hampering the ease of doing business within the economy especially in the export production sectors.

The measures and policy advice which are well aligned to those presented by the Honourable Minister of Finance and Economic Development in the Mid-Term Fiscal Review Statement are designed to deal with the structural imbalances that continue to stress the economy. The structural imbalances are evidenced by the large current account and fiscal gaps generated by the difficult internal and external conditions, a legacy of dollarisation policy inconsistencies/contradictions, policy slippages and procrastination in the implementation of critical Government policies. These imbalances are further exacerbated by adverse weather conditions and weak investor sentiment leading to the under performance of the national economy.

The under performance of the economy which started in 2012 – three years after dollarisation – is also greatly attributable to the legacy of policy inconsistencies/ contradictions when the country went into dollarisation in March 2009, by default and not by design, to tame hyperinflation. This was soon after the formation of the Government of National Unity in February 2009. The policy inconsistencies/contradictions which were secondary to the political settlement include over liberalisation of both the current and capital accounts at a time when the country had very limited access to foreign finance due to debt overhang, and non- conducive investment climate due to sanctions and unattractive domestic investment policies; wrong choice of trading currency and; failure to benchmark with regional comparators to maintain competitiveness.

It is therefore a combination of the current internal and external imbalances and historical challenges that need to be urgently addressed for the proper functioning of the multi-currency exchange system that, de facto, is currently totally dominated by the use of US$. This situation requires the nation to do things differently and WALK THE TALK to transform the economy by changing the narrative from consumption to production. The economy is hungry for production and productivity. With the public sector wage and salary bill being one of the highest in the world at more than 90% as a share of fiscal revenue and inflation at -1.4% being low or in negative territory (deflation) for two years now since 2014, real wages and salaries have increased, crowding out capital and social expenditure – thus undermining the economy’s capacity to enhance employment and to be competitive.

The business climate, on the other hand, affected by limited access to foreign finance; unfinished business on land security tenure and investment regulations; and high input costs, has not been conducive to attracting the much needed domestic and foreign investment. In addition the increasing fiscal gap in the absence of external financing has led to a decline in private sector activity and a reduction in domestic credit as financial institutions try to contain foreign exchange induced demand pressures attributable to lending activities.

As if the above harsh conditions are not enough, the economic impact of the El-Nino induced drought also increased the need for imports to reduce food insecurity, whilst the decline in mineral prices depressed export proceeds. In addition, amid low investor sentiment, the appreciation of the US$ induced higher than expected demand for this currency, reduced remittances in US$ terms, especially from South Africa and the United Kingdom (following Brexit) and generated speculation. With South Africa being Zimbabwe’s main trading partner – accounting for around 50% of total trade – where the rand depreciated against the US$, competitiveness has also been severely eroded.

Whilst efforts taken by Government to deal with the above fragile economic situation have been commendable, a stronger than anticipated impact of exogenous shocks highlighted above continued to exacerbate the economic slowdown and precipitated the decline in fiscal space and the cash shortage situation.

Walking the Talk within the above context of weak economic conditions requires policy precision and urgent implementation of necessary reform measures to transform the economy. The process won’t be easy but must be done. It requires national sacrifice, sincerity and integrity. It requires the ability to share the adjustment or transformation burden across the board and between the fiscal and monetary policies. Reliance on one policy instrument to manage the current structural imbalances would not be sustainable to transform the economy and to restore trust and confidence.

Overall, transforming the economy from a consumptive to a productive one requires fiscal discipline, production discipline, policy discipline, and message/communication discipline (speaking with one voice) in order to achieve the optimal levels of economic turnaround depicted by the following economic functional identities:

i. Liquidity = f*(Exports/Forex Earnings)

ii. Exports/Import Dependence = f(Production)

iii. Production = f(Investment Climate/Incentives/ Ease of Doing Business)

iv. Investment Climate = f(Policy Measures/Policy Consistency)

* f is read as function of

The rest of this Monetary Policy Statement is organized as follows; Section 2 discusses external sector developments and their implications on domestic economic activities. Section 3 looks at the status of the financial sector. Section 4 discusses the impact of policy measures introduced by the Reserve Bank in May 2016. Section 5 provides new policy measures to enhance confidence and production in the economy. Section 6 provides policy advice and Section 7 is the Conclusion. The Appendices provide an update on the re-engagement, a brief RTGS and Nostro concepts within the context of the multi-currency exchange system and an update on closed banks.

External Sector and Inflation Developments

Global Economic Developments

Global economic recovery has remained fragile with adverse consequences on developing economies like Zimbabwe. The situation has been exacerbated by the referendum outcome which approved Britain’s exit (Brexit) from the European Union.

The Brexit vote has deepened economic, political and institutional uncertainty within the EU, threatening the growth momentum witnessed in the first half of the year. This uncertainty has negatively affected investor confidence and financial market conditions. Moreover, the bumpy adjustment in China also continues to undermine sustained global economic recovery.

The recent global economic developments, have compelled the International Monetary Fund (IMF) to downwardly revise the initial global economic growth projections for 2016, by 0.1 percent, on account of the negative macroeconomic consequences, especially in advanced European economies. Consequently, the IMF is now projecting the global economy to grow by 3.1 percent in 2016 and 3.4 percent in 2017.

Growth in Sub-Saharan Africa is expected to decelerate from 3.3% in 2015 to 1.6% in 2016, representing a 1.4% decline from the initial forecasts in April 2016. This slowdown is primarily driven by the downturn in international commodity prices and Brexit fallout. Moreover, economic growth prospects for regional economies, notably, South Africa, Botswana and Zambia remain vulnerable to the downturn in international commodity prices and the depreciation of domestic currencies.

International Commodity Price Developments

International commodity prices have generally remained subdued over the recent past mainly on account of weakening growth prospects in China, the world’s largest metal consumer. This notwithstanding, global commodity prices reflected a modest recovery, albeit from a low base, during the first half of 2016 on the backdrop of transient stabilisation of global markets.

Specifically, gold prices firmed by 16.3%, from an average price of US$1 096.68/oz in January 2016 to US$1 274.99/oz in June, 2016. Similarly, platinum increased by 15.3% from US$853.65/oz in January 2016 to US$984.45/oz in June, 2016.

Implications of global economic developments on domestic economic activity

The effects of the weak global economy are being transmitted to the local economy mainly through depressed commodity prices and weakening trading partner currencies on the back of a relatively strengthening US$.

The sustained low commodity price environment, particularly for precious minerals and base metals have implications on the domestic economy as the country mainly depends on primary and semi-processed minerals. Weaker prices for precious and base metals imply lower export revenues for Zimbabwe, while depressed oil and food prices have a moderating effect on the country’s fuel and food import bill.

Moreover, the strengthening of the US$, coupled with sustained low commodity prices environment, has weakened growth prospects of the country’s major trading partners, notably South Africa, Botswana and Zambia. This development has resulted in sustained depreciation of these countries’ domestic currencies to the detriment of Zimbabwe’s trade competitiveness.

Resultantly, the manufacturing sector in Zimbabwe has continued to lose competitive ground. The exchange rate based loss in competitiveness has conspired with other supply side rigidities affecting the economy to intensify the influx of relatively cheaper imports into the economy.

Balance of Payments Developments

Merchandise Trade Developments

The economy has continued to be affected by sustained mismatches between export receipts and imports as evidenced by the disproportionate import absorption relative to exports especially for the period 2008-2015; a sign of weak economic fundamentals and over liberalisation of current and capital accounts.

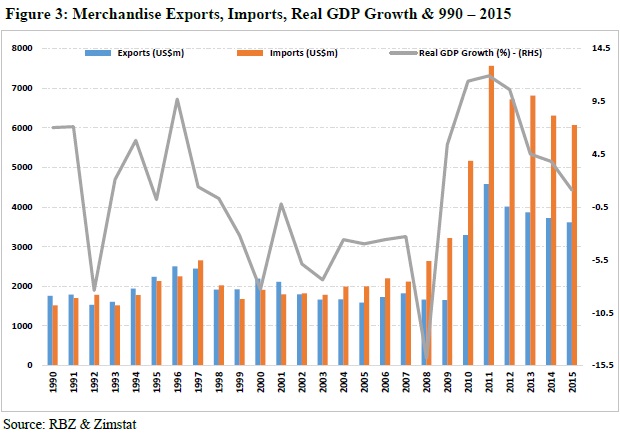

Figure 3 shows the Zimbabwe’s merchandise exports, imports and real GDP growth over the period 1990-2015. The graph also shows the sensitiveness of the economy to various shocks and vagaries, including droughts.

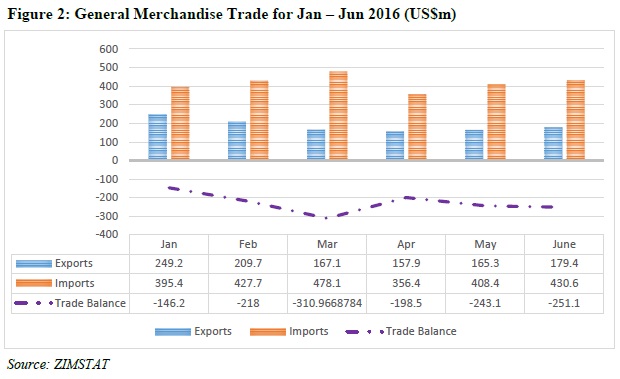

Over the period January to June 2016, merchandise exports declined by 8.7%, from US$1,232.3 million realized in 2015 to US$1,125.0 million in the corresponding period in 2016. Similarly, merchandise imports for the period January to June 2016 amounted to US$2,496.6 million, a 14.4% decline from US$2,917.1 million realized over the comparative period in 2015.

Figure 2 shows monthly merchandise exports and imports development for the period January to June 2016.

The decline in export and import performance is a reflection of the overall slowdown in economic activity, emanating from the drought induced contraction in agriculture, depressed commodity prices, suppressed capacity utilization in the manufacturing sector, as well as continued difficulties in accessing external lines of credit.

A combination of foreign currency management measures, including the prioritization of imports announced by the Reserve Bank in May 2016 and restrictions on selected imports by the Ministry of Industry and Commerce in July 2016, as well as the effects of a stronger US$ on the country’s terms of trade are expected to lead to a 0.9% decline in the import bill in 2016. Food imports (maize and wheat) are, however, expected to surge owing to the El Nino induced drought that ravaged the Southern African region, including Zimbabwe.

Continued reliance on imports of finished goods is unsustainable as it undermines current efforts to resuscitate domestic industrial production, leading to significant trade and current account deficits.

International Remittances

The continued appreciation of the US$ against regional currencies has also affected the dollar denominated value of remittance inflows, particularly from South Africa, which have over the years been a significant source of foreign currency in the country. The weakening of the South African rand against the US$, imply that Zimbabweans who are in South Africa are no longer in a position to send the same amount of money in US$ they used to remit back home. The rand value remittances have gone down in US$ terms.

This is evident from the decline in diaspora remittances of 13% from US$457.9 million for the period January to June 2015 to US$397.3 million in the corresponding period in 2016. This development has, therefore, affected general market liquidity in the economy with adverse effect on aggregate demand and sustained economic recovery.

Foreign Private Capital Flows

Private sector offshore external loans have been an integral source of liquidity in the economy since adoption of the multi-currency exchange system in 2009. These loans, as opposed to equity injection, have mostly been utilized for working capital and capitalization.

In the period from January 2016 – June 2016, the Bank approved and registered a total of 156 facilities with a monetary value of US$976.4 million. As is the norm, the agriculture sector has the highest contribution of 49% which is mostly buoyed by the tobacco sector. A comparison with the same period in 2015 shows that as at 30 June 2015, a total of 185 facilities had been approved with total monetary value of US$1.2 billion.

It is evident that due to the perceived unfavourable investment climate in Zimbabwe, investors have since devised a method to mitigate this perceived risk by using loans to finance their investments in the country as opposed to equity financing. This is also particularly true for some significant investors who have resorted to using the Engineering Procurement and Construction (EPC) model of investment as opposed to cash injection or equity into Zimbabwe like what they do in other countries such as Angola, Ethiopia, Mozambique, Zambia and Nigeria.

Policy Measures to Enhance Confidence and Production

The following policy measures are being put in place to enhance confidence and production in the economy, while simultaneously ensuring sustained financial stability:

-

Ease of securing offshore loans;

-

Incentivising inflows from the diaspora and private unrequited transfers;

-

Nostro stabilisation facilities of US$215 million;

-

US$20 million gold development initiative for small scale gold producers;

-

US$10 million horticulture/floriculture pre- and post-shipment facility;

-

Resuscitation of the credit guarantee scheme;

-

Establishment of an offshore financial centre;

-

Guidance on interest rates charged by microfinance;

i. Ease of Securing Offshore Loans. The current Exchange Control policy states that all external loans and commercial credit applications above US$10 million, for both the private sector and state owned enterprises, need prior approval by the Reserve Bank.

In order to enhance the ease of securing offshore lines of credit, the threshold of external loans that do not need prior Exchange Control approval is, with immediate effect, increased to US$20 million. Authorised dealers will still be required to register all such loans, in the usual manner, with the Reserve Bank.

In the same vein, the banking public should ensure that all unregistered offshore facilities should be regularised with the Reserve Bank through their banks.

ii. Incentivising inflows from the diaspora and private unrequited transfers. In view of the critical role of diaspora remittances in the economy and in order to enhance the remittance of such funds, the Bank shall be extending the export incentive scheme at a level of between 2.5-5% to diaspora remittances including any form of private unrequited transfers on funds remitted to Zimbabwe through normal banking channels with effect from 1st October 2016.

iii. Foreign Exchange/Nostro Stabilization Facilities of US$215 million. In order to deal with the current delays in the processing of outgoing foreign payments by banks the Bank has managed to secure facilities in an amount of US$215 million from international finance institutions to deal with the outgoing foreign payments backlog. In addition, negotiations are at an advanced stage to raise US$330 million from regional sources to enhance production and improve the liquidity situation in the country

iv. US$20 million gold development initiative facility to support small scale and artisanal miners. The Reserve Bank has secured US$20 million for Fidelity Printers and Refiners (FPR) to support small-scale and artisanal mining operations in order to increase gold production in the country.

With underground gold reserves estimated to be around 13 million tonnes, Zimbabwe’s rich gold reserves are clearly under-exploited. Only 586 tons have been officially mined over the past 36 years from 1980 to August 2016 as shown in Table 13. There is therefore great scope to vigorously promote the mining of gold across the country in order to liquefy the economy.

The gold development initiative (GDI) i.e the formalisation process of the small scale gold producers which will be executed according to responsible gold mining standards will need to be supported by fast-tracking the ease of doing business policy measures that include the reduction of cost of doing business as follows:

-

Reduction in custom milling fees from the current US$8 000 on the basis that when the fee was US$2 000 there were 485 millers which were registered but now at US$8 000 the registered millers are now around 51. The challenge is that there are many millers who cannot afford to pay the required fee of US$8 000 but are still operating and selling their gold on the black market and/or smuggling gold out of the country.

-

Reduction of licence fee for explosives. At US$100 about 5 000 small scale gold producers were registered and when the fee was increased to U$2 000 only 300 registered.

-

Reduction of the Environmental Management Agency (EMA) fees. The fee for exploiting the environment at 2% of gross revenue is extremely high. Consideration should be made to scrap this fee in order to enhance gold production.

-

Rural District Council (Land Development Tax) fees. These charges should be reviewed downwards based on ability to pay and must be determined in the context of all the other taxes, fees and charges that are applied to the mining industry.

-

Environmental Impact Assessment (EIA). The fee at between 0.8%-1.2% of total cost (with a maximum cap of US$2 million) remains high and is a huge barrier to investment. Reducing this to a rate of 0.05% of the project cost with a reasonable upper limit of US$50 000 would be in line with international best practice.

-

Reduction of Exploration Licenses, Claims and Related charges. The ground fees currently levied on prospective and mining firms in Zimbabwe are exorbitant.

v. US$10 million horticulture and floriculture pre and post shipment facility Horticulture and floriculture has previously been a fast growing export source with Zimbabwe having been one of the top exporting country in Africa in the 1990s. In order to increase production and exports of this sub-sector the Bank has arranged a facility of US$10 million for the pre and post-shipping requirements for producers of horticulture and floriculture. The facility would be disbursed through normal banking channels.

vi. Resuscitation of the credit guarantee scheme. The Reserve Bank is resuscitating the Credit Guarantee Scheme under the Export Credit Guarantee Company (ECGC) to support SMEs to increase production with effect from 1st October 2016.

The guarantee scheme, which used to be operational, was discontinued in 2002 as the guarantee limit had become too insignificant to support any meaningful business due to economic circumstances prevailing at the time. The credit guarantee scheme will address the challenge of lack of adequate and acceptable collateral, which is among the major challenges faced by marginalized groups including SMEs, women, youth, small holder farmers and rural population in accessing bank credit. The resuscitation of the credit guarantee scheme will go a long way in stimulating productive lending to the marginalized groups which will stimulate economic growth and poverty reduction.

vii. Guidance on interest rates charged by microfinance institutions. Microfinance has been identified as an important pillar of the National Financial Inclusion Strategy in Zimbabwe. However, the high costs of traditional microfinance loans limit the effectiveness of microfinance as a developmental and poverty-reduction tool. The high cost of microfinance loans is partly a reflection of the high cost of funds and the high transaction cost of traditional microfinance operations associated with high volumes of small, low-value loans.

The Reserve Bank has noted with concern that while banks’ lending rates have declined to an average of 15% per annum, some microfinance institutions continue to charge interest rates of over 20% per month. In this respect, microfinance institutions are expected to reduce their lending rates in the spirit of building inclusive financial systems and sustainable economic development. Accordingly, all microfinance institutions are urged to reduce their effective lending rates to a maximum of 10% per month effective, 1 October 2016. Future adjustments would need to be in tandem with the improvement on the tenure of the operating licences of microfinance institutions which are renewed on an annual basis.

vi. Establishment of an Offshore Financial Centre. The Bank is proceeding to putting in place mechanisms to establish an offshore financial centre as a confidence building measure under the auspices of the Special Economic Zones. Details of this initiative shall be unveiled in line with developments on the establishment of the Special Economic Zones in the country.

Policy Advice

1. Dealing with fiscal deficit in a sustainable manner that promotes economic growth requires a combination of the following measures;

-

Leveraging and securitisation of the country’s vast resources (minerals, non-core assets, residential and commercial land) to obtain capital for development and to close the fiscal deficit. The country’s enormous potential for sustained growth and poverty reduction is achievable through leveraging and securitisation of the country’s generous endowment of natural resources.

-

Acceleration of the reform and reorganisation of state owned enterprises (SOEs) including disposal through joint ventures and/or outright sale of some of the non-core SOEs to raise capital for development and to close the fiscal deficit. Additionally, production can be enhanced by granting investors contracts under long lease-back, build-operate-transfer (BOT) or build-own-operate-transfer (BOOT) agreements.

-

Putting in place an attractive investment climate to generate investment-led growth. Investment, like people, likes security. Security of investment is a good or conducive investment climate. Security of tenure is the best form of reward or incentive for business. Putting in place a conducive investment climate, fortunately, costs almost nothing yet the cost of not having it is horrendous.

-

The clarification of the Indigenisation Policy by His Excellency, the President, in April 2016 was a critical milestone towards improving the investment climate but the Act is yet to be aligned to the Policy. Similarly, regularisation of the 99-year land tenure security to make it a bankable document is yet to be done. Regularisation of these two policy documents will cost almost nothing but yet taking action on them would be tremendous as it would signal that domestic and foreign investment is welcome in Zimbabwe. We need to Walk the Talk to see this through in order to create an investor friendly environment.

-

Work being done by the Office of the President and Cabinet on the ease of doing business is quite commendable. What is now needed is to Walk the Talk by fast-tracking the implementation of all the identified areas of improvement especially as they pertain to the regulatory environment of doing business in Zimbabwe. Business license application forms, for example, should be available on-line, identical to all applicants and processed as a routine procedure.

-

Putting in place effective performance management systems across the board to ensure that performance commensurate with rewards and to inculcate positive work ethics. Special government projects that include the Brazil’s More Food Programme and the Directed Agriculture Programme should also be subject to this scrutiny.

2. Dealing with the current account deficit through internal devaluation to restore competitiveness. The use of the multi-currency exchange system puts Zimbabwe in a special circumstance that takes away the flexibility of adjusting the nominal exchange rate to maintain relative competitiveness. This unique situation is similar to the experience of countries within the Euro area, for example, which are unable to reverse a loss of competitiveness and balance of payments imbalance through a nominal devaluation of the currency.

For countries in this predicament, the loss of competitiveness can only be reversed internally, through relative gains in the efficiency in production and or through action to reduce cost of production i.e. internal devaluation – aimed mainly at reducing wages and other related labour costs.

Historical experiences with internal devaluation have been mixed. Others have been successful whilst other “successful” internal devaluation have been accompanied by falling demand and recession. The truth of the matter is that there are always pros and cons with devaluations, whether it is nominal or internal devaluation. Management and choice of internal devaluation is therefore critical.

Whilst there is general acceptance across the board in Zimbabwe about the need for internal devaluation in the country, there is no consensus on its form and format. Statistics at the Reserve Bank shows that the country would need to gradually devalue by up to 45% over a three year period to restore competitiveness.

Internal devaluation in Zimbabwe can be achieved through two possible approaches. The first approach would be for reduction in wages and salaries, accompanied by a similar reduction in the cost of finance and utility charges. Once this is done, the country would need to find a comparator to benchmark with to ensure that costs would not increase again without being checked. The challenge of this approach is that it can lead to further reduction in aggregate demand and to depression and recession. An equilibrium position would therefore need to be determined for this approach to produce desirable results.

The second approach, which also takes account of peculiarities in Zimbabwe, would be to achieve internal devaluation by a combination of improving the competitiveness of the country’s exports whilst simultaneously levelling the playing field between importers and domestic producers. This external rebalancing approach would incentivize foreign exchange earners (including all depositors) who are the generators of foreign currency whilst at the same time levying all payments of imports of goods and services (including withdrawals).

The intention of this approach would be to manage foreign exchange using market based mechanisms. There would be no charges on the use of plastic money and other electronic payment means. This approach would be neutral to net cash depositors. This will, therefore, be a market mechanism to support increased use of plastic money and for attracting foreign exchange deposits.

The downside risk of this second approach is that it would increase prices within the economy. The Bank, however, believes that the levy on imports would have a minimal effect on inflation given that the country is currently in deflation. Allowing some level of inflationary pressures in the economy would help to increase company revenues and profitability with positive multiplier effects on Government revenues, employment and GDP growth.

Most firms in Zimbabwe have already implemented or are in the process of implementing the first approach of internal devaluation of reducing wages and salaries. In view of these developments, it would be prudent to buttress the first approach by the second approach of internal devaluation to deal with the current account gap. The Bank shall be accelerating the second approach of internal devaluation after consultations with business and consumers.

3. Enforcement of local procurement by Government, in line with existing local procurement rules, is essential to conserve scarce foreign exchange and create a multiplier effect to stimulate local suppliers. The increased local business activity will, in time, boost fiscal space through increased taxes.

Conclusion and Outlook

The main message of this Monetary Policy Statement is that the Zimbabwean economy which is under stress as a result of harsh external conditions, structural imbalances and legacy policy inconsistencies/contradictions requires urgent and decisive steps to generate investment-led recovery in order to revamp production across all the sectors of the economy. Walking the Talk is critical because the large current account and fiscal gaps generated by these imbalances have inhibited private investment and restricted economic growth to as low as 1.1% in 2015 and projected at 1.2% in 2016. Enhanced production will increase employment, fiscal space, exports, economic growth and reduce import dependence and poverty. This is the panacea to restore trust and confidence.

Prudent fiscal policy is the main lever to deal with the internal imbalances and create an economic environment conducive to economic transformation. Accordingly, measures taken by the Bank in May 2016 and those presented in this Statement would need to be aligned to the fiscal policy measures presented by the Hon Minister of Finance and Economic Development in the 2016 Mid-Year Fiscal Policy Review Statement.

The measures would need to be supported by concessional external financing. Thus, with fresh foreign financing being an integral part of the envisaged Zimbabwe transformation agenda, completion of the re-engagement process is critical to improve Zimbabwe’s country risk premium.

The policy measures in this Statement and those announced by the Minister of Finance and Economic Development in the Mid-Year Fiscal Policy Review Statement, combined with fast-tracking re-engagement with the rest of the world will pave way for sustained growth and development. This would lead to an increase in economic growth from 1.2% this year to high single digits over the next three years, while inflation would be limited to lower single digits and international reserves would recover significantly.

Overall, the medium term looks favourable for Zimbabwe. Strong economic policies would also have an immediate impact in increasing competitiveness and attracting investment. The financial system which is currently constrained by the environment would be enabled to allocate scarce resources to the most effective use, and support production while facilitating the build-up of foreign exchange reserves.

I thank you.